Broadcom Inc. (AVGO)

Broadcom to tap corporate bond market for funds to pay down debt

Semiconductor company last issued bonds in July, when it raised $5 billion to refinance loans taken on to pay for its $69 billion acquisition of VMware Inc.

3 Tech Stocks You Can Buy and Hold for the Next Decade

Nvidia is an AI leader whose chips are still in high demand. Broadcom is tapping into a niche AI market.

Qualcomm, Broadcom, Marvell Stocks Rise. The AI Run Gets Boost After Micron's Strong Outlook.

Chip stocks rose Thursday on the back of Micron's AI demand outlook.

Should You Buy Super Micro Computer Stock Before Oct. 1?

Super Micro Computer is following in the footsteps of Nvidia and Broadcom with a 10-for-1 stock split. Investing in Nvidia and Broadcom around the times of their respective splits has produced mixed results.

Broadcom (AVGO) Price Prediction and Forecast 2025-2030

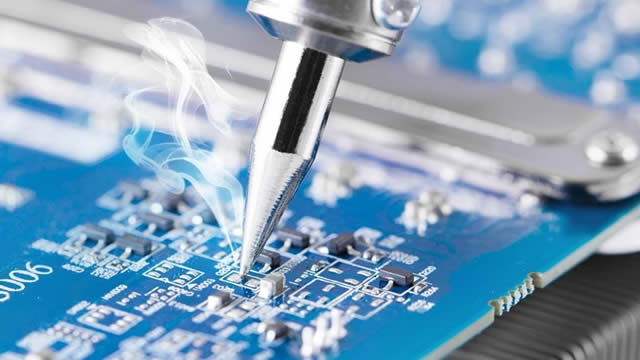

The explosive demand for semiconductors and microchips has grabbed news headlines and led the market higher over the past few years.

Why Broadcom Is AI's Big Winner

Broadcom targets a $150 billion AI semiconductor market with 30-40% annual growth, driving significant revenue potential. Fiscal 2024 AI revenues projected at $12 billion, growing 33% YoY, with $16 billion expected in 2025. Key AI customers include Google, Meta, and ByteDance, with potential collaboration from OpenAI further strengthening market position.

3 Dividend Stocks to Double Your Position In

All three have great growth potential.

Call Traders Cheer Resurgent Broadcom Stock

Earlier this month, semiconductor stalwart Broadcom Inc (NASDAQ:AVGO) shed by 10.4% after a dismal earnings report.

Warren Buffett's Secret Portfolio Is Dumping Shares of 3 Supercharged Artificial Intelligence (AI) Stocks (No, Not Nvidia!)

Thanks to an acquisition in 1998, Berkshire Hathaway became the owner of a specialty investment fund that now manages $602 million in assets. The asset managers of Buffett's secret portfolio have been net-sellers of stocks over the past two years.

2 Stock-Split Stocks to Buy Before 2025

Nvidia and Broadcom are two chip stocks that recently issued stock splits. Nvidia looks unstoppable after posting another quarter of strong growth despite increasing competition.

Better Artificial Intelligence Stock: Nvidia vs. Broadcom

Both companies are flourishing as strong AI demand drove year-over-year revenue growth. Broadcom made a strategic acquisition last year to strengthen its AI offerings.

Is Broadcom a Millionaire-Maker Stock?

A $10,000 investment in Broadcom around the time of its IPO would now be worth close to $1 million. The company could be the next big AI winner through its custom chips and networking components.