American Express Co. (AXP)

American Express (AXP) Declines More Than Market: Some Information for Investors

American Express (AXP) closed the most recent trading day at $327.97, moving 1.21% from the previous trading session.

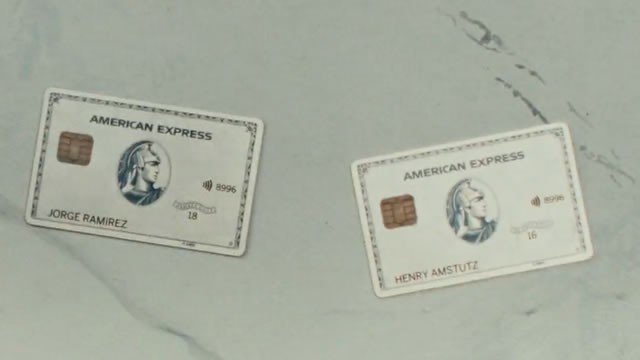

I don't want to pay the new $895 American Express Platinum fee — but will canceling the card hurt my credit score?

If you tell Amex you want to cancel, the company might offer you some cash, points or miles as an incentive to keep your card.

Will American Express (AXP) Beat Estimates Again in Its Next Earnings Report?

American Express (AXP) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

American Express (AXP) Stock Slides as Market Rises: Facts to Know Before You Trade

American Express (AXP) closed the most recent trading day at $332.16, moving 2.97% from the previous trading session.

Why American Express (AXP) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

2 Warren Buffett Stocks To Buy Hand Over Fist and 1 To Avoid

If you're ever in need of a new stock pick, you can always borrow an idea or two from Berkshire Hathaway's (BRK.A 0.55%) (BRK.B 1.06%) portfolio of holdings hand-picked by Warren Buffett himself. And you should.

3 Warren Buffett Stocks to Avoid Today

These are the most overvalued stocks in Berkshire Hathaway's portfolio.

Here's Why American Express (AXP) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

American Express Company (AXP) Presents At Barclays 23rd Annual Global Financial Services Conference (Transcript)

American Express Company (NYSE:AXP ) Barclays 23rd Annual Global Financial Services Conference September 9, 2025 9:00 AM EDT Company Participants Christophe Le Caillec - Chief Financial Officer Conference Call Participants Terry Ma - Barclays Bank PLC, Research Division Unknown Attendee Presentation Terry Ma Research Analyst Okay. We're going to get started.

Earnings Growth & Price Strength Make American Express (AXP) a Stock to Watch

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

American Express (AXP) Suffers a Larger Drop Than the General Market: Key Insights

American Express (AXP) concluded the recent trading session at $315.8, signifying a -1.05% move from its prior day's close.

If I Could Only Buy 1 S&P 500 Stock From Each Sector for the Rest of 2025, I'd Go With These 11 Dividend Stocks

The Global Industry Classification Standard assigns each stock into a market sector to make it easier for investors to compare companies to their peers and track broader market movements.