AstraZeneca PLC American Depositary Shares (AZN)

AstraZeneca announces $50bn US investment in manufacturing and R&D

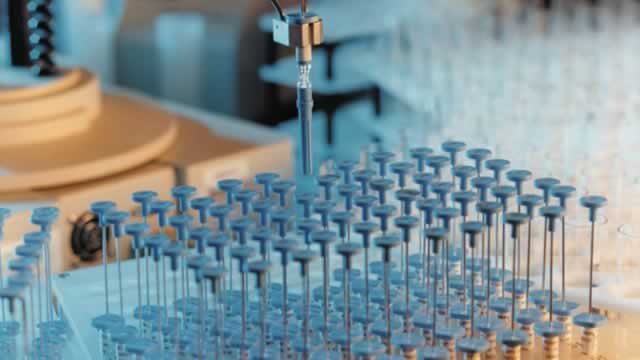

AstraZeneca PLC (LSE:AZN) has unveiled plans to invest $50 billion in the United States by 2030, marking its largest-ever commitment to a single country and signalling a major boost for domestic drug manufacturing and research. The centrepiece of the investment is a proposed multi-billion-dollar drug manufacturing facility in Virginia, which would be the company's largest single site worldwide.

AstraZeneca to invest $50 billion in the U.S. as pharma tariffs weigh

AstraZeneca has become the latest pharma firm to announce a multi-billion investment in the U.S. The Anglo-Swedish biotech firm has committed to spend $50 billion by 2030.

AstraZeneca to invest $50B in US economy by 2030

British biopharmaceutical giant AstraZeneca plans to invest $50 billion in the United States by 2030, expanding its presence in the company's largest market.

Astrazeneca (AZN) Stock Falls Amid Market Uptick: What Investors Need to Know

Astrazeneca (AZN) closed the most recent trading day at $69.26, moving 1.17% from the previous trading session.

AstraZeneca's AL Amyloidosis Drug Misses Goal in Late-Stage Studies

AZN's anselamimab fails to meet key goals in late-stage AL amyloidosis trials despite signs of subgroup benefit.

AstraZeneca shares open lower after rare disease drug fails to meet main trial goal

AstraZeneca PLC (LSE:AZN) shares opened lower on Wednesday after a late-stage trial of its experimental treatment for AL amyloidosis failed to meet its primary target in the overall patient group. The CARES phase III study tested anselamimab, a drug designed to clear harmful protein deposits in organs.

Astrazeneca (AZN) is a Top-Ranked Growth Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

AstraZeneca Meets All Key Goals in Phase III Hypertension Study

AZN hits all endpoints in phase III study for baxdrostat, a first-in-class treatment targeting hard-to-manage hypertension.

Here's Why Astrazeneca (AZN) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

AstraZeneca shares show signs of life after successful trials of hypertension drug

Baxdostat trials showed immense promise for huge available market.

AstraZeneca drug lowers high BP in late-stage study; shares rise

AstraZeneca 's experimental drug baxdrostat has been successful in lowering high blood pressure in a late-stage study of people whose condition was hard to control or treat, the Anglo-Swedish drugmaker said on Monday, sending shares up 2%.

AstraZeneca and GSK slide on Trump threats but analysts see positive catalysts ahead

Shares in AstraZeneca PLC (LSE:AZN) and GSK PLC (LSE:GSK, NYSE:GSK) were both down over 1% on Friday, but the shares are worth buying, analysts at Shore Capital said. Blue-chip shares across London and Europe were lower on Friday, after Donald Trump scaled up his tariff rhetoric again.