Barrick Mining Corporation (B)

Rare Buying Opportunities: Deeply Undervalued With Big Upside Catalysts

It is rare to find stocks that are both deeply undervalued and have powerful near-term upside catalysts. We share two of them in this article. We detail why the market is discounting them and why this does not make sense.

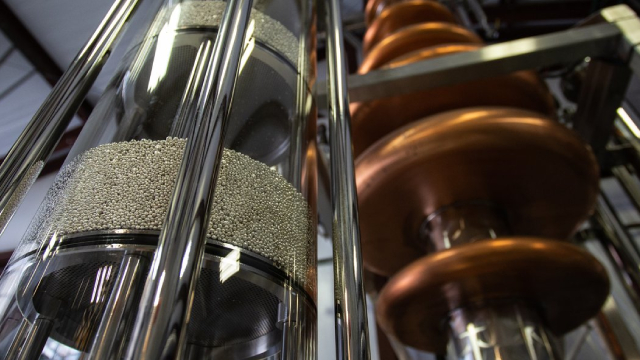

Can Barrick Mining's $2B Lumwana Expansion Power a New Era of Growth?

B's $2B Lumwana expansion targets a copper output surge, fueling its push toward long-term, low-cost growth.

Why Barrick Mining (B) is a Top Momentum Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Should You Invest in Barrick Mining After a 35% Rally in 6 Months?

B has surged 35% in six months, fueled by rising gold prices and bullish trends despite production cost headwinds.

Here's Why Barrick Mining (B) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Here's Why Barrick Mining (B) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

3 Gold Miner Stocks To Buy Today

Gold mining stocks have experienced stellar price action over the past year, mainly due to investors being increasingly interested in alternative assets due to, in many cases, their inherent status as safe-haven assets.

Barrick Mining's Key Projects Advance: Will Execution Fuel the Future?

B's gold and copper projects, including Goldrush and Reko Diq, aim to reshape its output and boost cash flow.

Why Barrick Mining (B) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Barrick Mining's Free Cash Flow Shines: Can It Power Future Growth?

B posts a 12-fold surge in free cash flow in Q1, boosting its growth firepower amid strong gold and copper price tailwinds.

Why Barrick Mining (B) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Barrick Mining's Surging AISC a Drag: Time to Reassess the Cost Curve?

Barrick's AISC jumps 20% in Q1 on higher cash costs and lower output, raising red flags for margin pressure.