Brookfield Infrastructure Partners L.P. (BIP)

Brookfield Infrastructure Partners (BIP) is a Top Dividend Stock Right Now: Should You Buy?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Brookfield Infrastructure (BIP) have what it takes?

Why an Underrated Dividend Giant Deserves Space in Your Portfolio

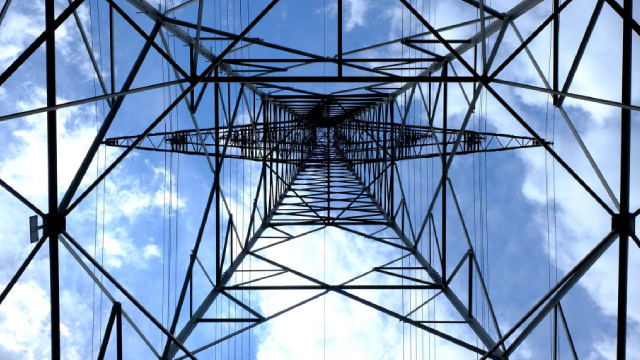

At a time when investors tend to chase the latest big tech or data center winner, Brookfield Infrastructure Partners L.P. NYSE: BIP can slip through the cracks despite its strong potential to appeal to dividend stock hunters.

Brookfield Infrastructure Partners (BIP) Could Be a Great Choice

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Brookfield Infrastructure (BIP) have what it takes?

Pick These 5 Bargain Stocks With Alluring EV-to-EBITDA Ratios

SCSC, TASK, SBH, BIP and EIX stand out with attractive EV-to-EBITDA ratios and strong earnings outlooks.

Top 5 Dividend Stocks Yielding Over 5% for Effortless Passive Income

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Weak Jobs Report Creates A Golden Buying Opportunity For These 3 Stocks

July's weak jobs report triggered a market sell-off and raised expectations for a September Fed rate cut. However, there were several stocks that did not respond how they should have. I discuss 3 of these stocks in this article and the golden opportunity this provides to investors.

8 Of My Favourite Dividend Stocks To Survive - And Thrive - In This Market

We are entering a volatile era driven by aggressive government growth strategies, short-term debt, and higher inflation tolerance. Investors must adapt accordingly. Stocks are expensive and bonds offer little incentive, so focus on sectors with inflation resilience: industrials, energy, materials, and select REITs. Avoid overpaying for hype; stick to quality names that can weather inflation and cyclical swings to protect and grow wealth in uncertain times.

This More Than 4%-Yielding Stock's Smart Strategy Continues to Pay Big Dividends

Brookfield Infrastructure (BIPC -1.56%) (BIP -0.22%) has a straightforward investment strategy. The global infrastructure operator acquires high-quality assets on a value basis, enhances their operations, and, eventually, sells the mature business.

Brookfield Infrastructure Partners L.P. Limited Partnership Units (BIP) Q2 2025 Earnings Call Transcript

Brookfield Infrastructure Partners L.P. Limited Partnership Units (NYSE:BIP ) Q2 2025 Earnings Conference Call July 31, 2025 9:00 AM ET Company Participants Brian A.

3 Dividend Stocks to Buy With $10,000 for $652 in Passive Income

These dividend stocks have underlying businesses generating stable cash flows. All three of them currently have dividend yields above 5%.

5 Rock-Solid Dividend Stocks Under $50 With Room to Run

Looking for high-yield dividend stocks below $50? Here are the top five.

Trump's Trade Deal With China May Have Just Made Dividend Investing Great Again

President Trump's trade deal with China may reduce the risk of accelerating inflation. This should give the Fed more flexibility to cut interest rates in a weakening economy. The biggest winner in all of this? Dividend stocks.