BlackRock Inc. (BLK)

BlackRock (BLK) Stock Falls Amid Market Uptick: What Investors Need to Know

In the closing of the recent trading day, BlackRock (BLK) stood at $766.17, denoting a -0.33% change from the preceding trading day.

BlackRock TCP Capital: This 12% Yielding BDC Is Likely Fairly Valued

BlackRock TCP Capital completed the acquisition of BlackRock Capital Investment in Q1'24, creating a larger and more diversified BDC focused on first liens. The company's solid Q1 earnings pushed shares into a new up-leg, but TCPC has a high non-accrual percentage and is overly invested in variable rate loans. BlackRock TCP Capital has a solid distribution coverage ratio and is trading above net asset value.

BlackRock Favoring Growth Heading Into Second Half

The BlackRock Target Allocation Team, which runs model portfolios followed by many advisors, turned even more bullish this week. Indeed, the current allocation to stocks is the highest it has been since 2021.

The Growth Stock Grandmasters: 3 Picks That Will Checkmate the Market

Growth stocks remain the best way to ensure superior investment returns — and some are killing it right now. Smart management, savvy decision making and long-term catalysts is causing certain stocks to vault higher and outperform the broader market.

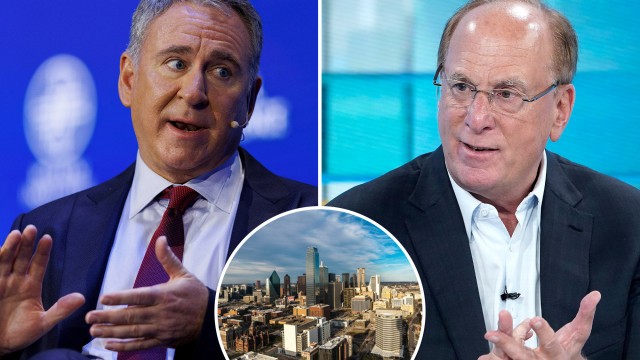

Citadel Securities, BlackRock back Texas Stock Exchange in challenge to NYSE, Nasdaq

BlackRock and Citadel Securities are among the financial heavyweights that are backing the creation of the Texas Stock Exchange.

Are You Looking for a High-Growth Dividend Stock?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does BlackRock (BLK) have what it takes?

What You Need To Know About the Blackrock-Backed Texas Stock Exchange

Texas may soon be the home of a new national stock exchange, as the TXSE Group announced plans Wednesday to officially file registration papers with the Securities and Exchange Commission (SEC) to create the Texas Stock Exchange.

BlackRock (BLK) Laps the Stock Market: Here's Why

BlackRock (BLK) closed at $777.37 in the latest trading session, marking a +0.69% move from the prior day.

Why BlackRock Stock Is a Must-Buy for Long-Term Investors

While the iShares Bitcoin Trust (NASDAQ: IBIT ) is the world's largest Bitcoin ( BTC:USD ) fund with nearly $20 billion in net assets, that doesn't necessarily make BlackRock (NYSE: BLK ) bulletproof, but BlackRock stock has a lot more going for it. BlackRock was founded in 1988 by CEO Larry Fink and seven other partners.

16 Years As A Dividend Growth Investor: Challenges, Opportunities And A Look Ahead

I started a dividend growth portfolio in 2008 and have seen steady increases in dividends over the years. The portfolio has also delivered sizable total returns. The portfolio is focused on dividend growth stocks that increase their dividends every year, and with dividends that are reinvested to improve returns. The portfolio is managed according to a business plan that embodies best practices for this type of portfolio, developed over the years.

BlackRock's bitcoin ETF on verge of eclipsing Grayscale's fund

BlackRock is vying for the most assets managed by exchange-traded funds that track bitcoin prices, making a quick ascension to challenge the dominance of Grayscale Investments.

Bitcoin dips, BlackRock finally trumps Grayscale as ETF top dog

Bitcoin (BTC) closed 1.5% lower on Tuesday and continued to fall against the US dollar today, bringing the BTC/USD pair over 3% lower week on week to trade at $67,792 at the time of writing. Despite bitcoin's indifference, a watershed, albeit widely expected, event has occurred in the bitcoin exchange-traded fund space, with BlackRock Inc (NYSE:BLK)'s iShares Bitcoin Trust (IBIT) flipping the Grayscale Bitcoin Trust (GBTC) as the largest bitcoin fund globally.