B2Gold Corp (BTG)

Why B2Gold (BTG) Outpaced the Stock Market Today

The latest trading day saw B2Gold (BTG) settling at $3.30, representing a +1.54% change from its previous close.

Gold Sales Explode at Costco as Investors Buy 3 Dividend Gold Stocks Hand-Over-Fist

24/7 Wall St. Insights Demand for gold continues to skyrocket as the precious metal surges toward $3,000 per ounce.

Why 5 Dividend Gold Stocks May Be the Best October Trade Ever

24/7 Wall St. Insights Gold hit an all-time high in late September and could be going much higher.

B2Gold: Good Growth Prospects In Production, Low Forward P/E And High Dividend Yield

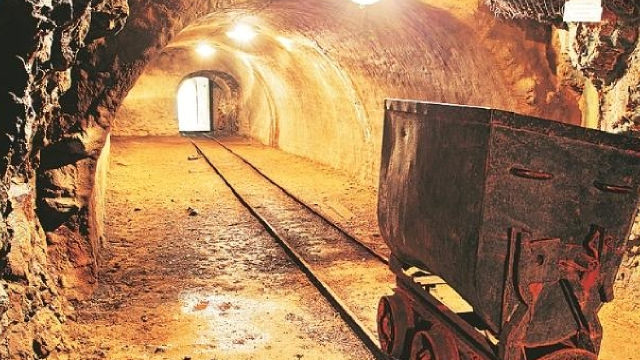

B2Gold Corp. is a leading mid-tier gold mining company with significant operations in Mali, Namibia, the Philippines, and Canada, making it a BUY at current prices. The Fekola mine in Mali is the flagship project, expected to increase production to 580,000 ounces in 2025 under a new government agreement. Otjikoto mine in Namibia is stable with expected production of 190,000 ounces in 2025, focusing on cost control with an AISC of $1060 per ounce.

B2Gold (BTG) Ascends While Market Falls: Some Facts to Note

In the latest trading session, B2Gold (BTG) closed at $3.14, marking a +1.95% move from the previous day.

B2Gold (BTG) Declines More Than Market: Some Information for Investors

The latest trading day saw B2Gold (BTG) settling at $3.25, representing a -1.81% change from its previous close.

Why consolidation is a 'real dilemma' for the miners - B2Gold's Clive Johnson

Michael McCrae is leading Kitco's coverage of the mining sector. McCrae, who has both an MBA and CMA, knows how to build digital media properties.

B2Gold (BTG) Rises But Trails Market: What Investors Should Know

In the most recent trading session, B2Gold (BTG) closed at $3.31, indicating a +1.53% shift from the previous trading day.

B2Gold: A Hidden Gem Amidst Rising Gold Prices And Expansion Projects

B2Gold is positioned to benefit from high gold prices, with the Goose Project in Canada and Fekola mine expansion driving future growth. Despite underperformance, B2Gold's diverse portfolio and recent agreements in Mali mitigate risks, making it undervalued compared to peers. Q2 results showed a 4.6% revenue increase despite lower production, with a strong outlook supported by rising gold prices and upcoming projects.

B2Gold Stock Trading Cheaper Than Industry at 6.44x: Buy or Hold?

BTG is currently undervalued. We analyze the company's growth prospects to determine if now is a good time to scoop up the stock or exercise restraint.

B2Gold: High Quality, Underappreciated Gold Producer With Impressive Growth Potential

B2Gold is a fundamentally strong gold producer with growth potential from the Goose Project in Canada and Fekola Complex expansion in Mali. Despite facing headwinds in 2024, B2Gold maintains solid operations, low costs, strong balance sheet, and attractive dividend yield. Valuation analysis suggests a fair value of $5.02, with potential upside of 76.83% from the current stock price of $2.69, making B2Gold stock a compelling buy opportunity for long-term investors.

B2Gold (BTG) Dips 10.5% Post Q2 Earnings: Should You Buy It?

B2Gold (BTG) witnesses a y/y dip in Q2 earnings on excavator damage at its Fekola mine and cuts its 2024 guidance. Higher gold prices will negate the impacts of lower production on 2024 revenues.