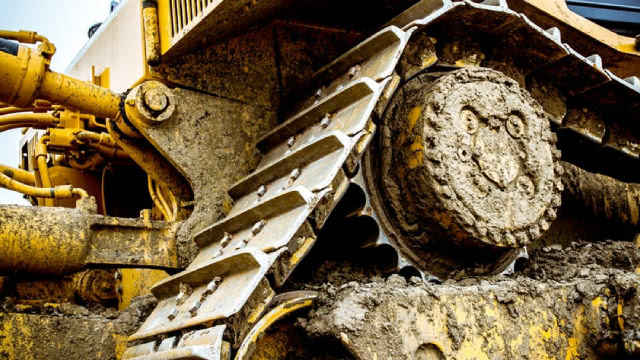

Caterpillar Inc. (CAT)

CAT Stock Trades at Premium Value: Should You Buy, Hold or Sell?

Caterpillar' record Q3 revenues and rising backlog contrast with ongoing earnings pressure and steep valuation, keeping investors on alert.

Here is What to Know Beyond Why Caterpillar Inc. (CAT) is a Trending Stock

Caterpillar (CAT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Caterpillar vs. Deere: Which Equipment Stock is the Better Buy Now?

CAT's renewed revenue growth, rising volumes and exposure to major secular trends set it apart as DE faces continued demand and earnings pressure.

Is Caterpillar Set to Transform On-Site Energy for Data Centers?

CAT teams with Vertiv to deliver pre-designed power and cooling architectures built for fast, reliable data center deployment.

Caterpillar Inc. (CAT) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Caterpillar (CAT) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here Are Friday's Top Wall Street Analyst Research Calls: Applied Materials, Caterpillar, Home Depot, Microsoft, Shake Shack, StubHub and More

The futures are trading lower to close out the week after a dreadful day on Wall Street on Thursday, during which all the major indices were hammered.

Caterpillar's Volume Momentum is Building: Can the Recovery Last?

CAT's broad Q3 volume rebound across all segments signals a sharp momentum shift after prolonged declines.

Like Dividends? 3 Dividend Aristocrats Worth a Look

Everybody loves dividends, essentially investors' form of payday. They can help limit drawdowns in other positions and provide a passive income stream, two key traits that all market participants enjoy.

Zaman: Caterpillar is becoming an AI infrastructure supplier

Aadil Zaman, Partner at Wall Street Alliance Group, says a market pullback is inevitable, with leadership shifting from AI giants to AI enablers like Caterpillar as demand for data-center infrastructure surges.

Why Investors Need to Take Advantage of These 2 Industrial Products Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

The Zacks Analyst Blog Caterpillar, Komatsu and Terex

Chicago, IL – November 10, 2025 – Zacks.com announces the list of stocks featured in the Analyst Blog. Every day the Zacks Equity Research analysts discuss the latest news and events impacting stocks and the financial markets.

Caterpillar Inc. (CAT) Analyst/Investor Day Transcript

Caterpillar Inc. ( CAT ) Analyst/Investor Day November 4, 2025 10:00 AM EST Company Participants Alex Kapper - Vice President of Investor Relations Joseph Creed - CEO & Director Jason Kaiser - Group President Anthony Fassino - Group President of Construction Industries Group Denise Johnson - Group President of Resource Industries Bob De Lange - Group President of Services, Distribution & Digital Andrew R. Bonfield - Chief Financial Officer Conference Call Participants Jamie Cook - Truist Securities, Inc., Research Division Angel Castillo Malpica - Morgan Stanley, Research Division Kyle Menges - Citigroup Inc., Research Division Jerry Revich Jairam Nathan - Daiwa Securities Co. Ltd.