Cameco Corporation (CCJ)

DeepSeek Dip: Is the Nuclear Energy Sell-Off a Buying Opportunity

The stock market's response to emerging technologies can sometimes be as volatile as the innovations themselves. A recent example of this occurred on January 27, 2025, when a sharp sell-off hit the nuclear energy sector.

Why Shares of Cameco, Denison Mines, and Uranium Energy All Crashed Today

Monday opened bleakly for uranium mining stocks. Over the weekend, Chinese artificial intelligence (AI) start-up DeepSeek announced it has developed a large language model by the same name that took just two months and cost only $6 million to develop -- yet somehow seems to be outperforming AI developed by ChatGPT over much more time and at far greater cost.

Cameco (CCJ) Surpasses Market Returns: Some Facts Worth Knowing

In the most recent trading session, Cameco (CCJ) closed at $56.86, indicating a +0.96% shift from the previous trading day.

Cathie Wood Dumps Sam Altman's Surging Nuclear Startup; Buys Key Uranium Player

Cathie Wood sold Sam Altman-backed Oklo on Tuesday and purchased uranium refiner Cameco. The post Cathie Wood Dumps Sam Altman's Surging Nuclear Startup; Buys Key Uranium Player appeared first on Investor's Business Daily.

Why Cameco, Oklo, and Nano Nuclear Were All Soaring Today

Shares of Cameco (CCJ 4.28%), Oklo (OKLO 7.51%), and Nano Nuclear Energy (NNE 5.55%) all rose today after a report from the International Energy Agency (IEA) was released. Cameco, up 4.4% as of 3 p.m.

AI Demand Sparks Opportunities for These 3 Nuclear Energy Leaders

2025 appears poised to be a banner year for nuclear energy companies. Demand for energy has never been higher—the U.S. Energy Information Administration estimated that the United States' total power demand for 2024 was 4.1 trillion kilowatt-hours (kWh), a record, and estimates for 2025 are even larger.

Cameco Corporation (CCJ) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Cameco (CCJ). This makes it worthwhile to examine what the stock has in store.

Cameco (CCJ) Surpasses Market Returns: Some Facts Worth Knowing

Cameco (CCJ) concluded the recent trading session at $49.06, signifying a +0.53% move from its prior day's close.

Cameco Corporation: Big Tech Can Afford To Bring Back Nuclear

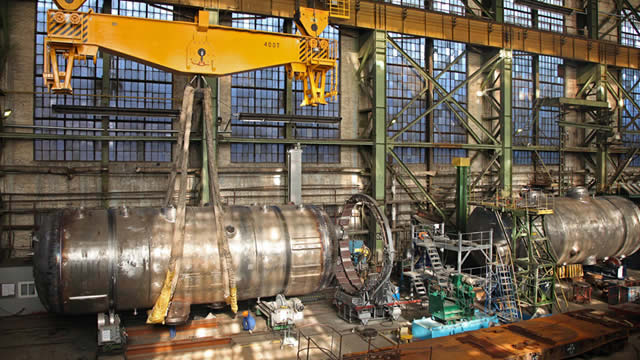

Cameco Corporation, the world's largest publicly traded uranium company, benefits from rising electricity demand driven by AI and data centers, positioning nuclear power as a key solution. The uranium market is concentrated and geopolitically unstable, with Cameco's substantial reserves and production capacity ensuring long-term stability and growth. Cameco's strategic investments, including a 49% stake in Westinghouse, and expansion of key assets, aim to boost revenue, cash flow, and shareholder returns.

Obtain Nuclear Exposure with This Strategy

Nuclear energy stands at the cusp of the global push for a low-carbon, greener, and more resilient energy future. And investors can find exposure easily through Zacks Thematic Screens.

Cameco (CCJ) Stock Declines While Market Improves: Some Information for Investors

Cameco (CCJ) concluded the recent trading session at $51.38, signifying a -0.39% move from its prior day's close.

3 Top Nuclear Stocks to Buy in January

Artificial intelligence (AI) took the world, and the stock market, by storm in early 2023 and has not slowed since. Investors have flocked to the companies developing and producing the chips to power AI models, the cloud companies building massive AI data centers, and even the software companies deploying AI applications.