Cemtrex Inc. (CETX)

Summary

CETX Stock Dips After Q3 Earnings Show Higher Revenue, Narrower Loss

Cemtrex posts higher third-quarter fiscal 2025 revenue and narrower losses, but non-operational charges weigh on net results.

Cemtrex Stock Surges Following Q2 Earnings, Margins Expand

CETX returns to profitability in the second quarter of fiscal 2025 with strong revenue growth and margin gains, signaling positive momentum ahead.

CETX Stock Falls Post Q1 Earnings Decline on Security Segment Weakness

Cemtrex's first-quarter fiscal 2025 witnesses a wider net loss due to a sharp drop in security segment revenue despite growth in industrial services.

Cemtrex Inc. (CETX) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

When is the next earnings date?

Has Cemtrex Inc. ever had a stock split?

Cemtrex Inc. Profile

| Transportation Infrastructure Industry | Industrials Sector | Saagar Govil CEO | NASDAQ (CM) Exchange | 15130G873 CUSIP |

| US Country | 264 Employees | 13 Jun 2019 Last Dividend | 29 Sep 2025 Last Split | 9 Sep 1998 IPO Date |

Overview

Cemtrex, Inc. is a diversified technology company that offers a wide range of services and products predominantly focused on security, industrial services, and corporate management. With operations in both the United States and international markets, Cemtrex has established itself in various sectors including security and surveillance, industrial maintenance, and high precision equipment installation. Originally named Diversified American Holding, Inc., the company underwent a rebranding to Cemtrex, Inc. in December 2004. Since its incorporation in 1998, Cemtrex has been committed to leveraging technology to deliver advanced solutions across multiple industries. The company’s headquarters are located in Brooklyn, New York, positioning it at the heart of one of the country’s most vibrant business communities.

Products and Services

- Security and Surveillance Systems

- Industrial Services

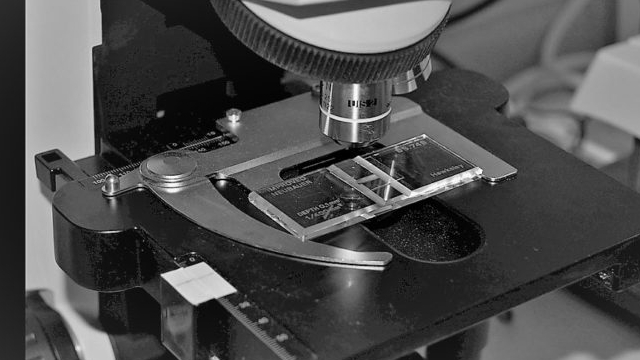

Cemtrex provides advanced security and surveillance systems, including browser-based video monitoring, analytics-based recognition systems, cameras, servers, and access control systems. These technologies are designed for use in a variety of settings such as industrial and commercial facilities, federal prisons, hospitals, universities, schools, and government offices. By leveraging artificial intelligence and data algorithms, these solutions offer critical security insights and efficiencies.

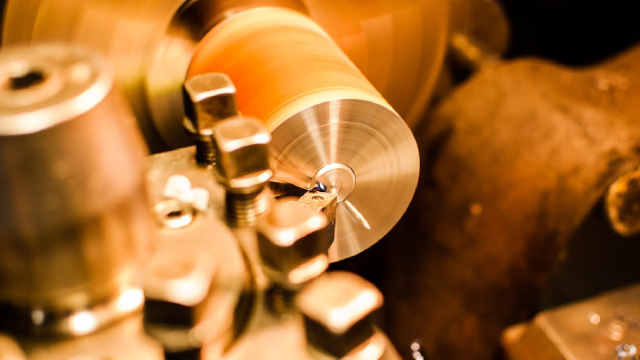

The company’s industrial services encompass rigging, millwrighting, in-plant maintenance, equipment erection, relocation, and disassembly. Target markets for these services include automotive, printing and graphics, industrial automation, packaging, and chemicals among others. These services are crucial for the installation of high precision equipment and provide comprehensive maintenance and contracting solutions across the machinery, packaging, printing, chemical, and other manufacturing sectors. This broad range of services underscores Cemtrex’s role in supporting the operational efficiency and equipment reliability of its clients.