Cool Co Ltd. (CLCO)

Silver (XAG) Forecast: Bullish Silver News Points to More Gains—If Powell Doesn't Cool It

Silver surges past $60 on tight supply and strong demand, but traders watch Powell's message closely as it could cool the silver rally and shape the near-term outlook.

AvalonBay Trims '25 Outlook as Rent Trends Cool & Operating Costs Rise

AVB lowers its 2025 outlook as slower job growth, softer occupancy and rising costs weigh, even as low future supply and a $3.6B pipeline offer support.

Gold (XAUUSD) and Silver Cool Off After Rally: Will Key Support Zones Hold?

Gold and silver retreat from resistance and consolidate as hawkish Fed signals and the U.S. government's reopening reduce safe-haven demand, with key support levels and upcoming data now guiding the next move.

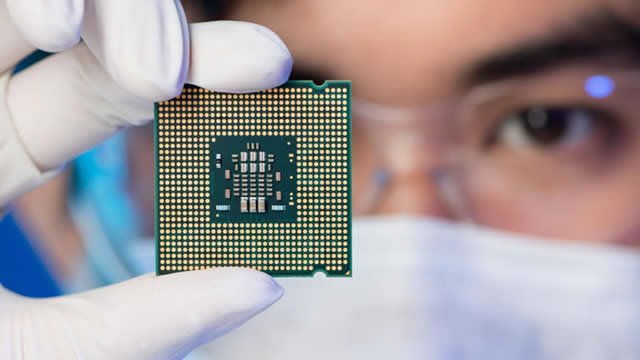

Amkor Technology: After Bullish Run, Expected To Cool Off Its Circuits

Amkor Technology, Inc. is a key player in semiconductor packaging, recently beating EPS estimates and surging 84% since May, gets prior buy rating lowered a notch to a hold. AMKR benefits from strong macro demand and pipeline growth, but faces mixed profitability metrics, modest dividend yield, and recent negative cashflow trends. Despite robust momentum and long-term growth prospects, AMKR stock's valuation is slightly elevated and Wall Street consensus implies near-term downside.

Cash is Old School, Code is Cool: Top Mobile Payment Stocks to Buy

From AI-driven wallets to QR-enabled dining, mobile payments are redefining money movement. Meet the four stocks leading the charge.

Are Transportation Stocks Lagging Cool Company Ltd. (CLCO) This Year?

Here is how Cool Company Ltd. (CLCO) and International Consolidated Airlines Group SA (ICAGY) have performed compared to their sector so far this year.

Can MTV Be Cool Again? Paramount's New Owner Plots Cable Revival

The newly combined media company is exploring ways to revive MTV and other once-mighty channels while rivals spin them off.

Cool Company Ltd. (CLCO) Q2 2025 Earnings Call Transcript

Cool Company Ltd. (NYSE:CLCO ) Q2 2025 Earnings Conference Call August 28, 2025 8:00 AM ET Company Participants Johannes P.

Cool Company: Modern Ships, Long Contracts, And Deep Discount

Cool Company benefits from long-term charters that provide cash flow stability amid volatile spot markets. Global energy transition and limited shipyard capacity position CLCO to create future demand without heavily spending on newbuilds. Despite short-term free cash flow pressure from vessel investments, the company still has a healthy balance sheet and strong equity cushion.

Play It Cool: Why Comfort Systems USA Is a Hidden AI Winner

Suppose you heard mention of a stock that's ridden the artificial intelligence wave to a 1,300% gain over the last five years. In that scenario, you'd probably envision industries like semiconductors, computer software, or maybe cybersecurity.

Home Price Increases Cool, Fed Chair on Capitol Hill Today

The tech-heavy Nasdaq again leads the way in today's pre-market, up +213 points, +0.97%.

Buy 4 Discretionary Stocks With Upside as Inflation Continues to Cool

Cooling inflation, easing trade tensions, and rate cut hopes lift outlook for discretionary stocks like NFLX and FOX.