Coinbase Global, Inc. (COIN)

Buy the Surge in Coinbase (COIN) or First Solar (FSLR) Stock?

Coinbase Global (COIN) and First Solar (FSLR) stock led another day of exuberant market gains, soaring over +20% respectively.

Coinbase is replacing Discover on the S&P 500 stock market index: Here's why and what that means

One of the world's most well-known stock market indexes, the S&P 500, will soon look a little different. That's because its roster of 500 companies is getting a shakeup, which will see the cryptocurrency exchange Coinbase Global join the index.

Coinbase shares jump after S&P 500 inclusion

Shares of Coinbase Global Inc (NASDAQ:COIN) rose nearly 19% on Tuesday after S&P Dow Jones Indices announced the cryptocurrency exchange will join the S&P 500, marking a major milestone for the digital-asset sector. The move makes it the first crypto-focused company to be added to the benchmark U.S.

Wall Street sets Coinbase stock price target for next 12 months

Coinbase (NASDAQ: COIN) flew high in the night between May 12 and May 13, 2025, as the world's biggest publicly-traded cryptocurrency exchange is set to join the S&P 500.

Coinbase to Join S&P 500

Coinbase, which trades on the Nasdaq under the ticker symbol COIN, will replace Discover Financial.

The wait is over: Coinbase is finally joining the S&P 500 index

Coinbase Global Inc. is joining the S&P 500 index next Monday, S&P Dow Jones Indices announced.

Coinbase shares spike as crypto exchange set to join S&P 500, replacing Discover Financial

Coinbase is joining the S&P 500, replacing Discover Financial, which is being acquired. Shares of the crypto exchange soared in extended trading after the announcement.

Here is What to Know Beyond Why Coinbase Global, Inc. (COIN) is a Trending Stock

Zacks.com users have recently been watching Coinbase Global (COIN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Coinbase: Q1 Miss Was Expected, Time To Excel Beyond Forecasts

Coinbase reported a Q1 2025 EPS miss of -87%. The stock did not move much. Referencing my previous Coinbase coverage, I explain why I expected this miss and how I can see Coinbase achieving much higher than expected EPS later this year. Key drivers are; an ongoing Bitcoin bull market, strong service revenue growth, and a slight re-rating of their valuation.

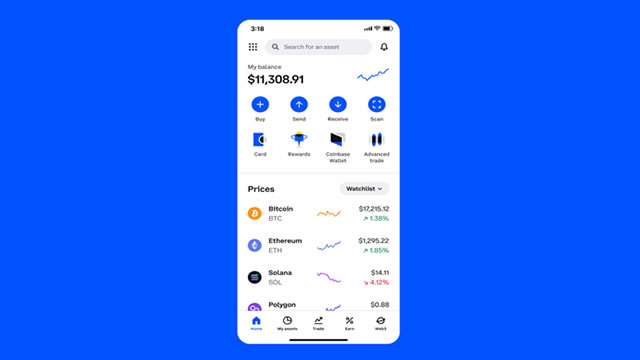

Coinbase aims to become the No. 1 financial service app in the world in 10 years, CEO says

Brian Armstrong says Coinbase is ready to partner with any bank or financial institution that wants to expand into crypto.

Coinbase Q1 Earnings Beat, Revenues Miss Estimates, Volumes Rise Y/Y

COIN's Q1 results reflect higher consumer and institutional transaction revenues and crypto asset prices.

Coinbase to buy Deribit in record $2.9bn crypto deal

Coinbase Global Inc (NASDAQ:COIN) is set to acquire Deribit, a crypto derivatives exchange based in Dubai, for $2.9 billion in a move that will significantly boost its international presence and place it in direct competition with global heavyweight Binance. The deal, announced Thursday, includes $700mn in cash and 11mn Coinbase class A shares.