Coinbase Global, Inc. (COIN)

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Reminds Shareholders of Coinbase Global, Inc. to Contact the Firm Today!

NEW YORK CITY, NY / ACCESSWIRE / November 8, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

2 Reasons To Like Coinbase After The Election, 1 to Still Avoid

Shares of Coinbase Global Inc NASDAQ: COIN, the crypto exchange with a market cap of around $64 billion, have had a roller-coaster year. For those of us who have been following the crypto space and its related stocks for some time, this is perhaps not all that surprising.

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Reminds Investors of Coinbase Global, Inc. to Contact the Firm Today!

NEW YORK CITY, NY / ACCESSWIRE / November 7, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

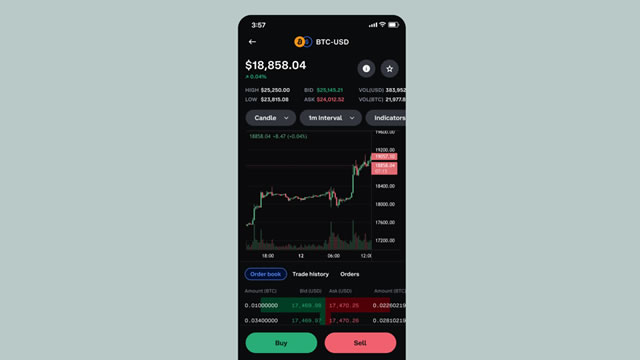

Can Coinbase Stock Double Under a Donald Trump Presidency?

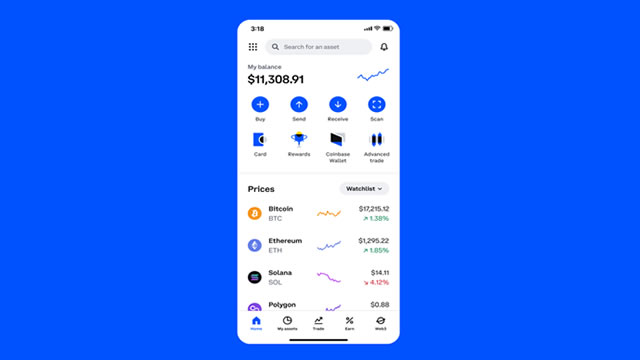

In the world of crypto, Coinbase (NASDAQ:COIN) is a leading centralized exchange that has become ubiquitous among U.S.

5 Industries to Watch in a Trump Administration

Equities usually rise regardless of who assumes the White House. However, savvy, active investors understand the importance of analyzing specific industries under a new administration.

Coinbase CEO Brian Armstrong is more than $2 billion richer after post-election stock pop

Coinbase shares soared 31% on Wednesday, their best performance on record, after the company's candidates had a big Election Day on Tuesday. CEO Brian Armstrong, who co-founded the crypto exchange in 2012, was the biggest winner as his holdings increased by over $2 billion.

Should You Seize the Opportunity on Coinbase's Recent Dip?

Coinbase's recent drop may look like a setback, but behind the dip lies a golden opportunity for investors willing to see the big picture.

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Coinbase Global, Inc. Shareholders with Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK CITY, NY / ACCESSWIRE / November 6, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

Coinbase Q3: Stablecoins, Layer 2, And Beyond

Coinbase aims for $2 billion in subscription and services revenue by 2024, up from $1.4 billion in 2023, diversifying beyond crypto trading. The company is enhancing its ecosystem with EURC stablecoin growth, a user-friendly smart wallet, and the low-cost Base Layer 2 solution. Despite a challenging Q3, Coinbase remains well-positioned for future growth, focusing on regulatory clarity and expanding into derivatives markets.

Coinbase Stock: Buy or Sell Today?

Coinbase's growth has slowed, but the company is still positioned to be a long-term winner on the blockchain.

Coinbase Global, Inc. (COIN) is Attracting Investor Attention: Here is What You Should Know

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Coinbase's big election bet is about to be tested

Coinbase was one of the the leading corporate donors this election cycle, backing candidates the company viewed as supporting its pro-crypto agenda. The crypto exchange gave more than $75 million to Fairshake and its affiliated PACs, including a fresh pledge of $25 million to support the group in the 2026 midterms.