Coinbase Global, Inc. (COIN)

Coinbase: A Bullish Year-End Could Spark A Multiple Expansion

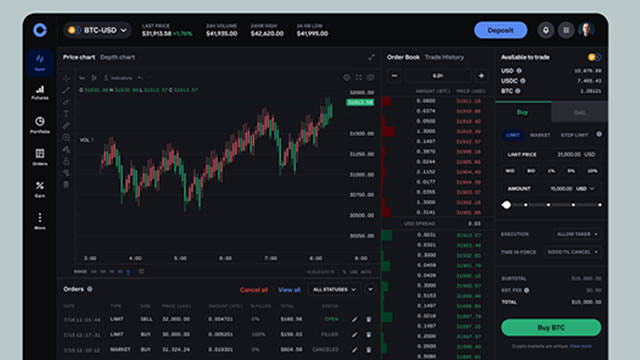

Coinbase Global, Inc. (COIN) is rated a Buy with a $385 price target, implying 17% upside over the next 12 months. COIN's 33% YTD price appreciation is driven by improved crypto sentiment and strong demand for Bitcoin, Ethereum, and Solana. Despite a mixed FQ2 2025 with a revenue miss, COIN delivered robust EPS growth, highlighting resilient business momentum.

Coinbase Global, Inc. (COIN) Stock Drops Despite Market Gains: Important Facts to Note

In the latest trading session, Coinbase Global, Inc. (COIN) closed at $331.95, marking a -3.07% move from the previous day.

Dividend Power: 2 ETFs That Could Supercharge Your Income Portfolio

Covered call ETFs like Bitwise COIN Option Income Strategy ETF and YieldMax SMCI Option Income Strategy ETF offer high income potential, making them attractive for income-focused investors despite risks of NAV and price erosion. ICOI provides monthly income via synthetic options on Coinbase, boasts a tax-efficient return of capital distributions, but has a short track record and higher expense ratio. SMCY offers a massive yield due to price declines, but its distributions are taxed as income, making it better suited for tax-advantaged accounts like Roth IRAs.

As Bitcoin Falls and Ethereum Rallies, Coinbase Stock Comes Back

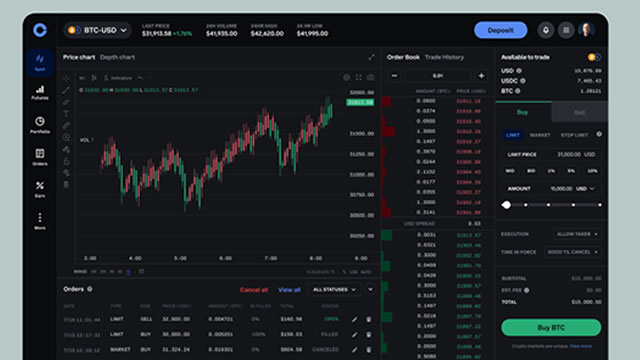

How a business generates its revenue should be the first consideration for any investor considering a potential investment in a stock, especially in today's uncertain world, marked by geopolitical conflicts and ongoing trade tariff negotiations. For this reason, understanding where risk appetites are headed is a key gauge for identifying the next potential “cash cow” in the market, so to speak.

Coinbase Global, Inc. (COIN) is Attracting Investor Attention: Here is What You Should Know

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Coinbase Global, Inc. (COIN) Is a Trending Stock: Facts to Know Before Betting on It

Coinbase Global (COIN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

COIN Loses 19% in a Month, Trades at a Premium: How to Play the Stock

Coinbase stock tumbles 18.9% in a month, trading below its 50-day SMA, as premium valuation and slowing earnings temper growth hopes.

Banned Coinbase ad portrays a dystopian Britain — with only crypto as an exit

A controversial ad gets banned from television — for a message that is only implied.

Coinbase to raise $2B through convertible debt offering

Coinbase Global Inc (NASDAQ:COIN) said on Tuesday it plans to raise $2 billion through a private offering of convertible senior notes, with $1 billion each due in 2029 and 2032. Shares fell nearly 5% in Tuesday morning trading as investors digested the new fundraising plan.

Investors Heavily Search Coinbase Global, Inc. (COIN): Here is What You Need to Know

Coinbase Global (COIN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Coinbase: High Platform Profitability

Coinbase's 17% share price drop on Friday is an overreaction to broader market weakness, not company fundamentals, and presents a long-term buying opportunity. Coinbase's Q2'25 earnings showed strong platform profitability, despite a revenue miss, with the company beating EPS estimates and maintaining robust net earnings. Regulatory clarity from the GENIUS Act strengthens the investment case for Coinbase by legitimizing stablecoins and the broader crypto ecosystem.

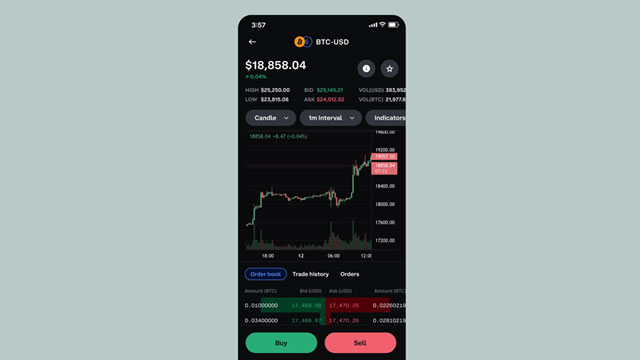

Why is COIN stock down today? Coinbase earnings have investors spooked

Coinbase, the largest U.S.-based cryptocurrency exchange, reported second quarter earnings on Thursday. Why is the stock tumbling?