Coinbase Global, Inc. (COIN)

Will COIN's Transaction Expense Efficiency Drive Sustainable Growth?

COIN's transaction expense discipline is turning crypto volatility into steady cash flow and a clearer path to profit.

Will Coinbase Global (COIN) Beat Estimates Again in Its Next Earnings Report?

Coinbase Global (COIN) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

The S&P 500's biggest winner is up 134% in 3 months

Coinbase (NASDAQ: COIN) stock has claimed the top spot among the S&P 500 (SPY) constituents over the past three months, surging approximately 134% during this period.

Is Trending Stock Coinbase Global, Inc. (COIN) a Buy Now?

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

5 Top S&P 500 Finance Stocks Outperforming the Index in 1H25

Five financial services stocks -- COIN, WRB, NTRS, GS and SCHW -- outpace the S&P 500 in 1H25 on strong fundamentals and strategic shifts.

Here's Why Sales & Marketing Spend is Pivotal for Coinbase

COIN doubled its 2024 marketing spend to fuel user growth, asset retention, and surging trading volumes across its platform.

Coinbase Bets on Tech to Drive Growth and Stay Ahead of Trends

COIN leans into tech investment to fuel growth, enhance security, and outpace fast-evolving crypto market trends.

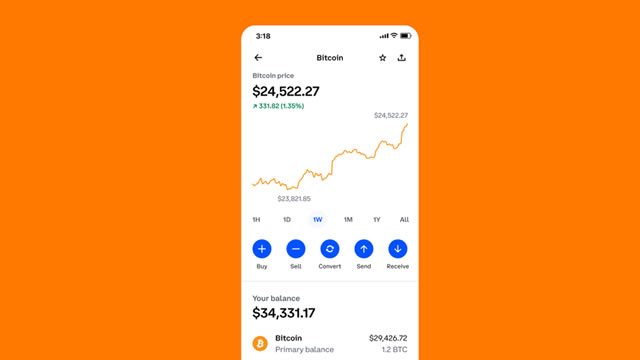

Here's why Coinbase stock price is about to explode higher

Coinbase stock price has surged by over 140% from its level in April, and is now hovering at its highest level since 2021 when it surged to its all-time high. Its market capitalization has jumped to over $90 billion, making it one of the top financial services companies in the US.

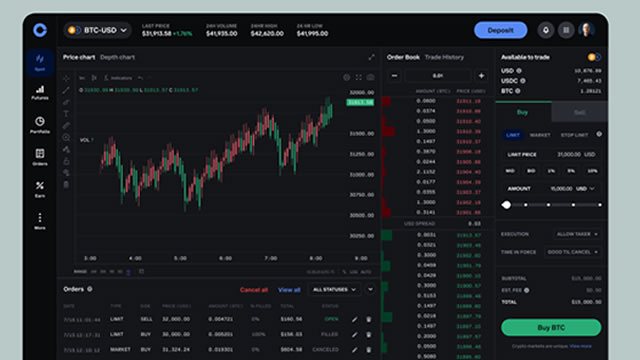

Coinbase Is Implicitly 'Eating Financial Services' And To That, I Say, Bon Appétit!

At first glance, Coinbase appears to be a play on crypto prices. Company profits and the stock price have been behaving that way. COIN started in 2012 as a bitcoin exchange and since then has added more coins to its trading repertoire and a lot more capabilities for its users. But the company has bigger visions. It says crypto is “eating financial services” and that it's number one in crypto.

Coinbase Global, Inc. (COIN) Stock Sinks As Market Gains: Here's Why

Coinbase Global, Inc. (COIN) reached $353.3 at the closing of the latest trading day, reflecting a -5.81% change compared to its last close.

Coinbase's stock is up 44% this month as Wall Street projects amazing profit growth

The cryptocurrency-trading platform is expected to put up big numbers through 2027 at least.

Coinbase Stock Drops From Record High. Cathie Wood Sold 33,000 Shares.

The cryptocurrency exchange hit a record high Thursday before giving back some gains.