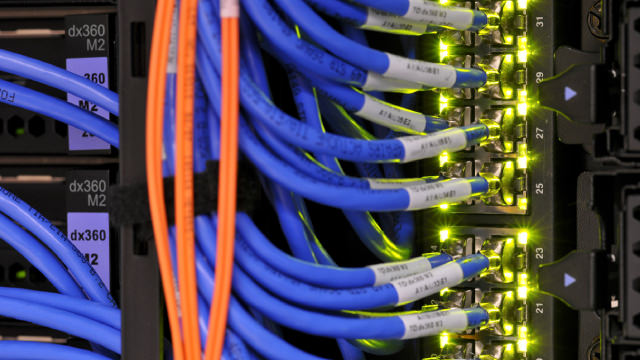

Cisco Systems, Inc. (CSCO)

Cisco Systems, Inc. (CSCO) Presents at UBS Global Technology and AI Conference 2025 Transcript

Cisco Systems, Inc. (CSCO) Presents at UBS Global Technology and AI Conference 2025 Transcript

Nvidia: Just Like Cisco In 2000

Nvidia Corporation is a dominant force in AI, but its valuation mirrors Cisco's pre-dot-com bubble peak, raising concerns of overexuberance. Despite strong earnings and revenue growth, NVDA's high valuation and market optimism may not be sustainable as infrastructure cycles mature. Power shortages and overbuilt datacenter capacity echo past tech bubbles, suggesting billions in capex may not yield expected returns.

Cisco Systems, Inc. (CSCO) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Cisco (CSCO) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Cisco's Networking Revenue Growth Picks Up: More Upside Ahead?

CSCO's networking revenues surge on AI and campus demand, with new edge tech and rising orders boosting its fiscal 2026 momentum.

Cisco Up 35% in a Year: Is There More Room for the Stock to Rise?

CSCO's AI-fueled order surge, new products and upbeat 2026 outlook lift momentum, even as valuation risks keep the stock in focus.

Why Cisco Systems (CSCO) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Cisco Is Going Up, But You Might Not Make Money

Cisco Systems (CSCO) shares have risen 9.5% over the past 21 trading days. This surge is indicative of a skyrocketing demand for AI infrastructure and robust networking outcomes, yet significant fluctuations like this usually provoke a critical inquiry: is the stock genuinely durable when market conditions decline?

Even Cisco's 2% Dividend Can't Save Them From Investor Hate

Shares of Cisco(NASDAQ:CSCO) are trading just under $78 per share.

Don't Overlook Cisco (CSCO) International Revenue Trends While Assessing the Stock

Explore Cisco's (CSCO) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Investors Heavily Search Cisco Systems, Inc. (CSCO): Here is What You Need to Know

Cisco (CSCO) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

S&P 500 Gains and Losses Today: Disney Drops After Sales Miss; Cisco Stock Climbs

Shares of a major media player dropped as underperformance from its TV networks dragged on its quarterly performance. Meanwhile, demand driven by the buildout of artificial intelligence infrastructure helped lift shares of a large tech firm.

Top Stock Movers Now: Cisco Systems, Walt Disney, Sealed Air, and More

Major U.S. equities indexes fell Thursday, a day after President Donald Trump signed a funding bill to end the longest federal shutdown in U.S. history. Technology shares dragged the Nasdaq down nearly 2%, while the S&P 500 and Dow Jones Industrial Average were also lower.