Cisco Systems, Inc. (CSCO)

Missed the Nvidia and Meta Run-up? 3 More AI Stocks to Buy Before It's Too Late

The tech stock selloff that began last month took the wind out of the sails of many previous high fliers.

Retirees Will Love These 3 Growth and Income Stocks

When it comes to retirement, setting a goal is important. Many investors may be looking for capital appreciation for their assets, looking to grow their assets faster than inflation over a given time frame.

Meta, Cisco And 2 Other Stocks Executives Are Selling

The Nasdaq 100 closed lower by over 300 points during Thursday's session. Investors, meanwhile, focused on some notable insider trades.

Drop Cisco Stock And Pick TC Energy And AerCap For Higher Gains?

If you are a Cisco (NASDAQ:CSCO) investor and took advantage of its recent run-up following the company's better-than-expected Q4 FY'24 results, it may be time to look elsewhere. As of this moment, we find TC Energy (NYSE:TRP) – an operator of energy infrastructure in Canada, the United States, and Mexico, and AerCap Holdings (NYSE:AER) – an aviation leasing company, as more attractive buys than Cisco.

Wall St. Vet Warns ‘Mass Layoffs Are Next'

Key Points: Mass layoffs, especially in tech, are tied to companies missing out on the AI boom.

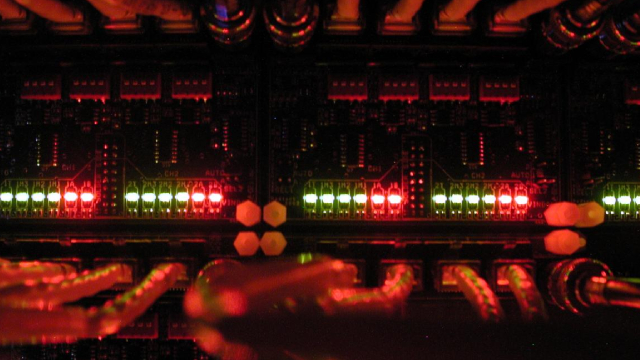

2 Old-School Tech Giants Winning in the AI Market

IBM's enterprise AI platform, paired with its consulting business, is winning over larger customers. Cisco is making progress selling its AI networking technology to hyperscalers.

Cisco employees face a month of silence ahead of second layoff in 2024

After tech giant Cisco announced plans for its second round of layoffs this year, employees tell TechCrunch that they will not know if they are affected for close to a month.

Cisco Systems Is Showing Strong Signs Of A Recovery

Cisco Systems reported a strong end to FY24 with sequential growth in networking equipment sales as customer inventory digestion occurs. Management laid out the groundwork for the next generation of Cisco as the firm undergoes a major restructuring to enhance their AI networking capabilities. Despite a dimming macroeconomic environment, Cisco is well-positioned for growth as enterprises invest in faster bandwidth capabilities for AI/ML testing and inferencing.

Cisco (CSCO) Reliance on International Sales: What Investors Need to Know

Evaluate Cisco's (CSCO) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

Cisco Systems, Inc. (CSCO) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Cisco (CSCO). This makes it worthwhile to examine what the stock has in store.

The Worst May Be Over for Cisco After Beating Estimates in Q4

Cisco Systems NASDAQ: CSCO is a U.S. technology firm and is the world's largest company in the communications equipment industry. Shares have seen significant underperformance compared to its sector, down 4%.

Can Cisco Stock Rebound To $60?

Cisco stock currently trades at $48.50 per share, roughly 17% below its pre-inflation shock high of $58.70 seen on December 29, 2021. Cisco's product sales have witnessed a slowdown as customers focused on utilizing the inventory purchased post the Covid-19 pandemic.