CSX Corporation (CSX)

What's in the Cards for CSX Stock This Earnings Season?

High operating costs are likely to have hurt CSX's bottom-line performance in Q2.

Analysts Estimate CSX (CSX) to Report a Decline in Earnings: What to Look Out for

CSX (CSX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

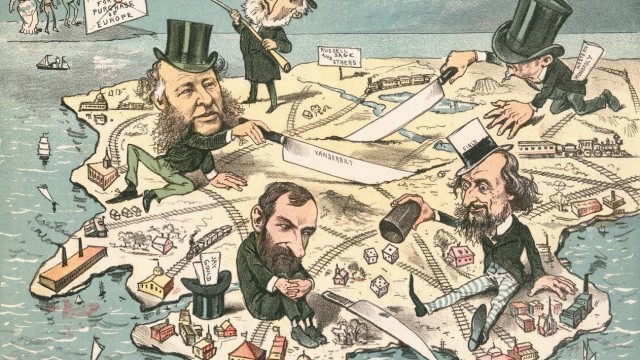

4 Reasons Why Railroad Stocks Will Soar As The 2020s Roll On

Railroad stocks are set to roll and we're going to climb aboard with two stocks—including one that's hiked payouts by 50% in five years—we'll delve into in a sec.

Here's Why CSX Stock is a Compelling Portfolio Addition

CSX's top line is bolstered by high export coal volumes and increased domestic intermodal shipments. Efforts to reward its shareholders are commendable.

5 Stocks With High ROE to Buy on Sustained AI-Infused Rally

Genuine Parts (GPC), CSX Corporation (CSX), PulteGroup (PHM), Kellanova (K) and Banco de Chile (BCH) are some of the stocks with high ROE to profit from as markets move up on AI-driven rally.

CSX Confirms The Bull Case, As It Remains One Of My Best Dividend Ideas

CSX Corporation remains a top-tier dividend growth stock with a focus on commodities and merchandise. Despite facing headwinds like inflationary pressures, CSX has navigated challenges effectively with diversified revenue streams. CSX continues to impress with its resilience, operational performance, and long-term growth potential, despite recent stock price underperformance.

Here's Why Investors Should Hold on to CSX Stock for Now

High export coal volumes, increased domestic intermodal shipments and growth in other segments boost CSX's top line. However, network issues and supply-chain disruptions are major headwinds.

The 3 Best Railroad Stocks to Buy Now: May 2024

Railroad traffic is a barometer of economic activity. In 2023, that worked in favor of the sector.

3 Growing Dividends Set To Cash In On ‘Industrial Revolution II'

This onshoring trend is roaring—but we contrarian dividend investors still have time to cash in. I've got a “3-pack” of cheap stocks that lets us do that, with dividends that are surging (or are about to!