China Yuchai International Ltd (CYD)

China Yuchai International: Seems To Have Found The Growth Catalyst Needed

China Yuchai International has pulled back recently after the stock put together a huge rally higher in 2025, but this could be an opportunity to get in. Where growth will come from came with a question mark not so long ago, but CYD seems to have found the answer, as reflected in recent income statements. Valuations have gone up in 2025, but strong earnings growth and the charts suggest the stock can go even higher.

China Yuchai: Favorable Short-To-Mid Term Prospects

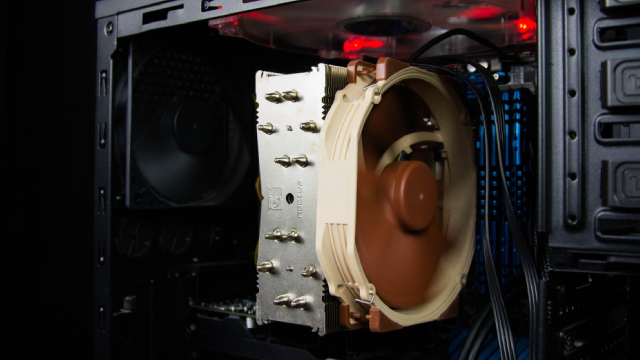

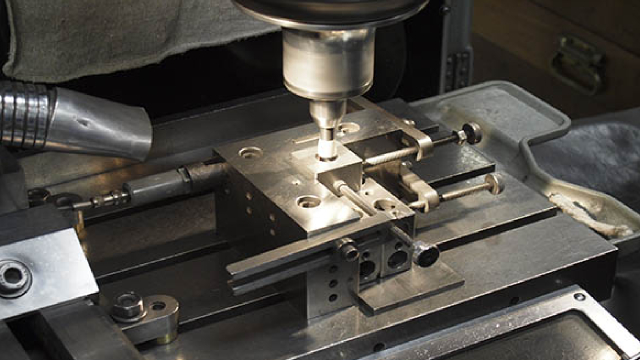

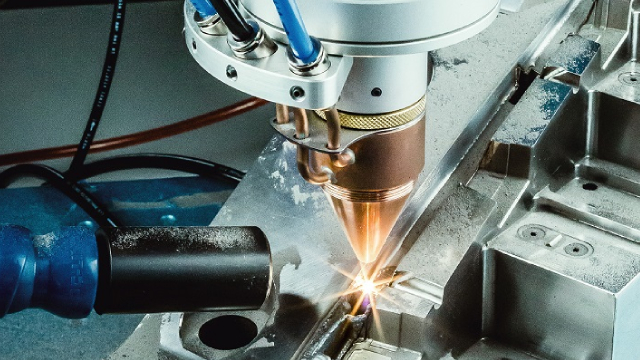

I remain bullish on China Yuchai, as the firm should continue to perform well for the rest of 2025 and beyond. CYD's full-year outlook is positive, considering trade-in incentives for Chinese trucks and the company's market share gains. Intermediate-term growth is supported by CYD's data center engine business and overseas ventures, particularly in Southeast Asia.

Best Momentum Stock to Buy for August 18th

TLN, CYD and MGIC made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on August 18, 2025.

Is China Yuchai International (CYD) Outperforming Other Auto-Tires-Trucks Stocks This Year?

Here is how China Yuchai (CYD) and Douglas Dynamics (PLOW) have performed compared to their sector so far this year.

Best Value Stocks to Buy for August 18th

ENVA, PDS and CYD made it to the Zacks Rank #1 (Strong Buy) value stocks list on August 18, 2025.

New Strong Buy Stocks for August 18th

MLCO, CYD, HMY, E and KE have been added to the Zacks Rank #1 (Strong Buy) List on August 18, 2025.

China Yuchai International Limited (CYD) Q1 2025 Earnings Call Transcript

China Yuchai International Limited (NYSE:CYD ) Q1 2025 Earnings Conference Call August 8, 2025 8:00 AM ET Company Participants Choon Sen Loo - Chief Financial Officer Kevin Theiss - Head of Investor Relations Tak Chuen Lai - General Manager of Operations Weng Ming Hoh - President & Director Conference Call Participants Don Espey - Shah Capital Management, Inc Junhao Li - Daiwa Securities Co. Ltd., Research Division Wei Shen - UBS Investment Bank, Research Division Yiming Liu - Haitong Securities Co., Ltd.

China Yuchai: A Cash-Rich Engine Maker Poised At The Cyclical Inflection

China Yuchai International is a vertically integrated, cash-rich engine maker trading at a deep value, with 80% of its market cap covered by net cash. The company benefits from long-term OEM contracts, extensive after market services, and strong R&D, positioning it well for future growth. Despite market fears over ICE exposure and state ownership, risks are overstated due to hybrid demand and shareholder-friendly actions like buybacks and dividends.

Has China Yuchai International (CYD) Outpaced Other Auto-Tires-Trucks Stocks This Year?

Here is how China Yuchai (CYD) and Xos, Inc. (XOS) have performed compared to their sector so far this year.

Are Auto-Tires-Trucks Stocks Lagging China Yuchai International (CYD) This Year?

Here is how China Yuchai (CYD) and Xos, Inc. (XOS) have performed compared to their sector so far this year.

China Yuchai's Valuation Looks Tempting, But Weak Cash Flow Says Otherwise

China Yuchai International Limited is facing liquidity risks, intense competition, and industry shifts despite strong revenue and profit growth in 2024. CYD's cash flow generation is weak, with a high P/OCF ratio and shrinking forward operating cash flow, raising concerns about financial stability. Rising costs and shrinking margins are squeezing profits, making CYD's current valuation appear unsustainable and overpriced.

China Yuchai International Limited (CYD) Q4 2024 Earnings Call Transcript

China Yuchai International Limited (NYSE:CYD ) Q4 2024 Earnings Conference Call February 25, 2025 8:00 AM ET Company Participants Kevin Theiss - Head, Investor Relations Weng Ming Hoh - President Choon Sen Loo - Chief Financial Officer Conference Call Participants Yiming Liu - Haitong Securities Pengyu Bai - Pinpoint Asset Management Andy Li - Daiwa Operator Good day, and thank you for standing by. Welcome to China Yuchai International Limited Second Half and Full Year 2024 Full Financial Results Conference Call and Webcast.