Dominion Energy, Inc. (D)

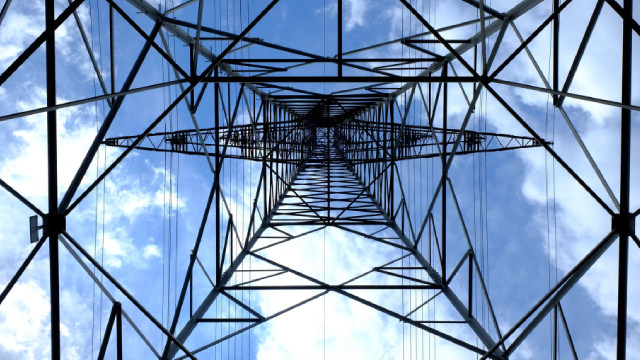

Dominion Energy looking at connecting data center directly to Connecticut nuclear plant

Dominion Energy would consider co-locating a data center at the Millstone Power Station in Waterford, Connecticut, CEO Robert Blue said. The nuclear plant provides more than 90% of Connecticut's carbon-free power.

These 2 Stocks Cut Their Dividends And We're Buying One

Here's one thing most folks get wrong about dividend cuts: They can (and often do) set up terrific buying opportunities!

Dominion Energy (D) Q2 Earnings and Revenues Lag Estimates

Dominion Energy (D) came out with quarterly earnings of $0.55 per share, missing the Zacks Consensus Estimate of $0.58 per share. This compares to earnings of $0.53 per share a year ago.

What to Expect From These 5 Utility Stocks in Q2 Earnings?

Let's focus on utilities like XEL, ETR, D, PNW and ED, which are scheduled to release second-quarter 2024 earnings on Aug 1.

Dominion Energy (D) to Post Q2 Earnings: What to Expect

Dominion Energy's (D) second-quarter earnings are likely to have benefited from strong demand from data centers and solid customer growth in Virginia and South Carolina.

These 2 Utilities Stocks Could Beat Earnings: Why They Should Be on Your Radar

Why investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates.

Dominion Energy (D) Ascends But Remains Behind Market: Some Facts to Note

Dominion Energy (D) closed at $52.70 in the latest trading session, marking a +0.76% move from the prior day.

Dominion Energy (D) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Dominion Energy (D) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Dominion Energy (D) Rises Yet Lags Behind Market: Some Facts Worth Knowing

Dominion Energy (D) reachead $51.80 at the closing of the latest trading day, reflecting a +0.76% change compared to its last close.

Dominion Energy Is Ahead Of The Field When It Comes To Dividends

Dominion Energy is at the top of the field, as it currently offers a 5.4% yield on dividends, and its stock is working toward a buy point.

Here's Why Dominion Energy (D) Gained But Lagged the Market Today

Dominion Energy (D) closed the most recent trading day at $49.75, moving +0.55% from the previous trading session.

Dominion Energy's (D) Arm to Buy Offshore Wind Lease for $160M

Dominion Energy (D) inks deal to acquire the Kitty Hawk North Wind offshore wind lease. This should help the company meet the growing customer demand from the region.