Dell Technologies Inc. (DELL)

DELL at 14.87X P/E is Trading Dirt Cheap: Right Time to Buy the Stock?

Dell Technologies' cheap valuation and surging AI server demand highlight its growth momentum and make it a compelling buy opportunity.

Dell Technologies (DELL) Stock Falls Amid Market Uptick: What Investors Need to Know

In the closing of the recent trading day, Dell Technologies (DELL) stood at $152.41, denoting a -1.44% move from the preceding trading day.

Is Dell Technologies (DELL) Stock Outpacing Its Computer and Technology Peers This Year?

Here is how Dell Technologies (DELL) and Advantest Corp. (ATEYY) have performed compared to their sector so far this year.

Dell Technologies (DELL) Suffers a Larger Drop Than the General Market: Key Insights

In the most recent trading session, Dell Technologies (DELL) closed at $160.98, indicating a -1.6% shift from the previous trading day.

This doctor raised $130 million from Michael Dell, Jim Breyer and others to try to fix health care

Austin, Texas-based startup Harbor Health raised $130 million from Michael Dell's family office, Breyer Capital and family office Martin Ventures. Cofounder and chief medical officer Dr. Clay Johnston launched Harbor after running Dell's namesake medical school.

Wall Street Analysts Look Bullish on Dell Technologies (DELL): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Hewlett Packard Or Dell: Which Stock Has More Upside?

Although Dell Technologies has experienced a 17% increase in the past month, its competitor Hewlett Packard Enterprise might be a more favorable option. Regularly assessing alternatives is fundamental to a robust investment strategy.

Dell Technologies (DELL) Outperforms Broader Market: What You Need to Know

Dell Technologies (DELL) reached $154.23 at the closing of the latest trading day, reflecting a +2.73% change compared to its last close.

DELL Gains Traction in Cloud Infrastructure: Can it Drive ISG Revenue?

Dell Technologies' AI-driven cloud infrastructure surge and expanding ISG portfolio are fueling strong revenue momentum amid fierce competition.

Dell: The Hardware Engine Behind Enterprise AI Adoption

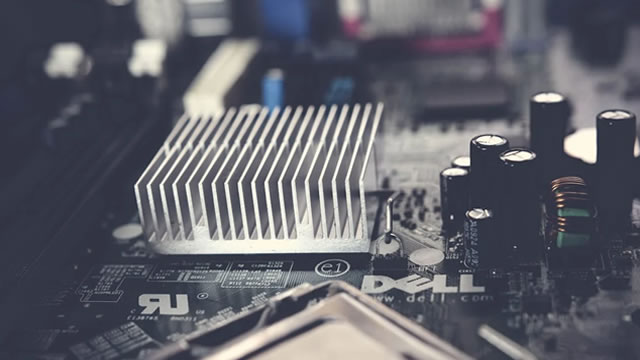

Dell has emerged as a key enabler of enterprise adoption of AI technology, supplying the infrastructure that powers inference workloads. The company's infrastructure business continues to drive solid revenue growth, with AI-server revenue rising at an exceptionally fast rate. The client facing business is also set to benefit from the upcoming PC refresh cycle and growing demand for AI-enabled PCs and affordable options for companies operating in developing nations.

Analysts Flock to Upgrade DELL After Big AI-Server Guidance Boost

Dell Technologies NYSE: DELL might not be the most exciting stock regarding tech investing, but shares have been performing very well in 2025. Year-to-date, Dell shares have provided a total return of approximately 35%.

Dell vs. HPE: Which AI Infrastructure Stock Is the Better Buy Now?

DELL's AI server boom and expanding edge portfolio give it a strong lead over HPE in the fast-growing AI infrastructure market.