Domino's Pizza Inc. (DPZ)

Domino's Stock Rises on Earnings. America Is Ordering Plenty of Pizzas.

The pizza chain's U.S. same-store sales growth accelerates to the highest rate since early 2024.

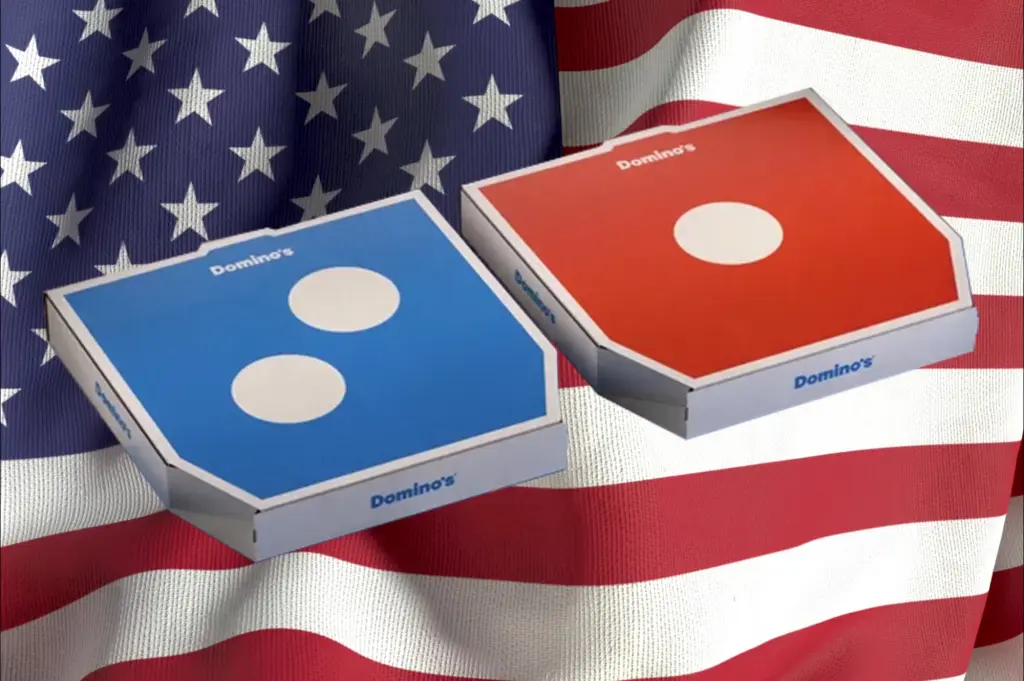

Domino's doubles down on red, white and blue in new logo — and marketing experts take note

Rebranding efforts often come when a company is struggling, but that's not the case for Domino's.

Domino's Q3 Earnings on Deck: Strong Sales, Softer Profits?

DPZ eyes solid third-quarter sales growth on new products and delivery deals, though profit margins may stay under pressure.

Domino's Pizza (DPZ) is a Top-Ranked Growth Stock: Should You Buy?

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Domino's Pizza Group: A 5.5% Dividend And 10x P/E For A Market Leader

Domino's Pizza Group shares have declined by more than 50% since 2022, now trading at a 10x P/E and a 5.52% dividend yield. Dominant market position: Domino's UK is by far the largest pizza chain in the country, with over 1,370 stores. It offers strong brand equity and economies of scale. Highly cash-generative model: Despite recent volatility, Domino's UK benefits from a strong supply chain business and consistent free cash flow over time.

Domino's Pizza Group: Historically Cheap Amid A Weak U.K. Macro Backdrop

Shares of sub-franchisor Domino's Pizza Group plc have been a terrible performer recently, falling around 40% in local currency due to unfavorable U.K. macro conditions. Despite declining volumes and soft sales, the company continues to gain market share in the U.K. Similarly, while franchisee-level profitability has dipped, it remains strong in absolute terms. The stock now trades at a depressed valuation, with its P/E below 12x and its dividend yield around 5.6%. Both look very attractive compared to historical levels.

Domino's Pizza Drops 9% in the Past Month: Buy Now or Wait?

DPZ stock slips 8.5% in a month, yet menu innovation, global expansion and digital upgrades fuel its long-term growth potential.

Can Domino's New Menu Additions Boost Average Ticket Size?

DPZ's Parmesan Stuffed Crust is fueling sales growth, boosting average tickets and winning customer praise as a long-term menu fixture.

Domino's Pizza: Strong Growth Momentum And Attractive Valuation

Strong growth drivers: innovation, DoorDash rollout, and global expansion. Margin gains from sales leverage despite slower supply chain benefits. Attractive valuation vs. historical average supports long-term upside.

Domino's Pizza Q2 sales exceed estimates—thanks to new items

Domino's Pizza surpassed analysts' expectations for second-quarter U.S. same-store sales on Monday, driven by new items on the menu and promotions, amid persisting macroeconomic uncertainties, sending shares up about 5% in early trading.

Domino's Delivers Another Discounted Entry for Income Investors

Domino's (NASDAQ DPZ) FQ2 results were weak, underperforming reduced expectations, with growth slowing and earnings in contraction, but that is not what investors should focus on. Those negative details are short-lived headlines that do not offset the increase, profits, improved business leverage, and substantial capital return.

Domino's Q2 Earnings Miss, Revenues Beat Estimates, Stock Up

DPZ stock jumps after second-quarter revenues beat despite an earnings miss, boosted by store growth and aggregator expansion.