EnerSys (ENS)

Unveiling EnerSys (ENS) Q4 Outlook: Wall Street Estimates for Key Metrics

Evaluate the expected performance of EnerSys (ENS) for the quarter ended March 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

5 Low Price-to-Book Stocks to Add to Your Portfolio in April

The P/B ratio helps to identify low-priced stocks with high growth prospects. GM, JD, PFE, STNE and ENS are some such stocks.

Here's Why Investors Should Invest in EnerSys Stock Right Now

ENS gains from strength across its segments, acquired businesses and shareholder-friendly policies.

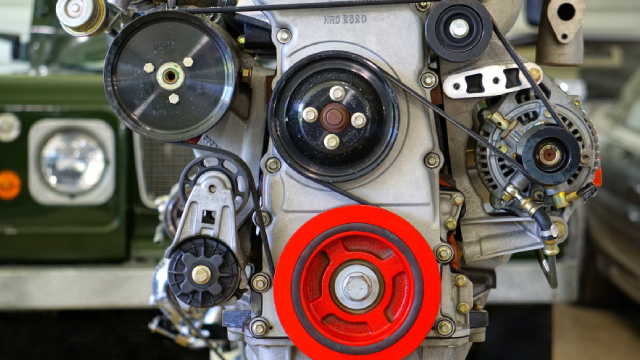

EnerSys to Shut Down Mexico Plant & Shift Production to US

ENS' restructuring plan includes the closure of its flooded lead-acid battery plant in Monterrey and moving its production to its existing manufacturing facility in Richmond, KY.

Here's Why EnerSys (ENS) is a Strong Value Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

EnerSys closes Mexico facility, moves production to US

Energy services provider EnerSys said on Tuesday it would close its flooded lead-acid battery manufacturing facility in Mexico and shift production to an existing plant in the United States.

ENS vs. ABBNY: Which Stock Is the Better Value Option?

Investors with an interest in Manufacturing - Electronics stocks have likely encountered both EnerSys (ENS) and ABB (ABBNY). But which of these two companies is the best option for those looking for undervalued stocks?

Is Enersys (ENS) a Great Value Stock Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

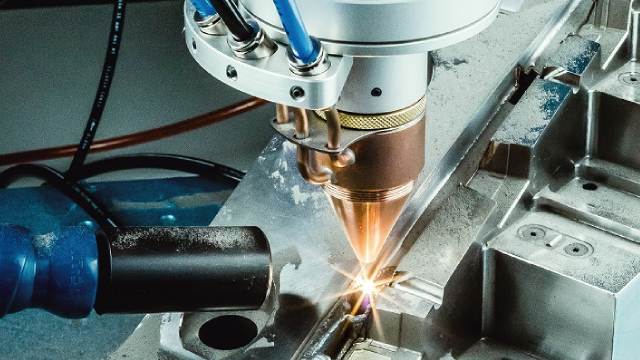

EnerSys: Strong Market Position, Strategic Growth Opportunities And Robust Financial Outlook

EnerSys is a leading US-based industrial battery manufacturer, benefiting from structural growth trends like electrification, automation, and data center expansion, making it resilient to economic shocks. Tax credits from the IRA, declining lithium prices, and ongoing innovation investments are enhancing operating margins and profitability, with a DCF analysis indicating a potential upside of over 50%. The company's diversified revenue streams across sectors like defense, telecom, and transportation, coupled with strategic acquisitions, position it for sustained growth and profitability.

4 Value Picks That Could Weather Tariff Volatility and Slowing Growth

Value investing is essentially about selecting stocks that are usually cheap but fundamentally sound. FMS, ENS, GM & ITRI boast a low P/CF ratio.

Why EnerSys (ENS) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

New Strong Buy Stocks for March 17th

TCBX, KMTUY, PAA, LMB and ENS have been added to the Zacks Rank #1 (Strong Buy) List on March 17, 2025.