Enovix Corporation (ENVX)

Enovix: 2025 Mass Production Sparks Optimism

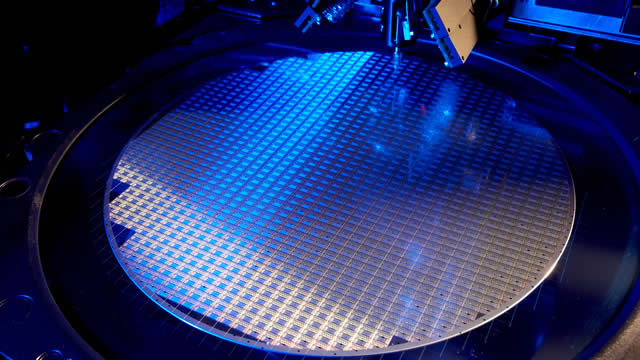

I recommend a Buy rating on Enovix due to successful mass production progress and commercialization readiness, positioning it for significant revenue growth. Enovix's Fab2 facility in Malaysia has completed Site Acceptance Testing for High-Volume Manufacturing, indicating readiness for mass production and customer shipments. Enovix is strategically positioned to meet the growing demand for high-capacity batteries in smartphones, IoT, EVs, and defense markets, with major OEMs already engaged.

2025 Is Enovix's Inflection Point With First Commercial Production

2025 Is Enovix's Inflection Point With First Commercial Production

Enovix: A Worthy Buy For Asymmetric Upside

Enovix Corporation's revenue scale up is progressing slower than expected due to guidance misses and lower-than-expected throughput in its first high-volume manufacturing line. But Enovix is progressing well on smartphone customer engagements, scaling up manufacturing operations, and on battery product R&D milestones, with no delays; a respectable achievement. Valuations remain optically high for this early-stage business, but I think it is difficult to assess it on traditional valuation metrics.

Enovix Corporation (ENVX) Q4 2024 Earnings Call Transcript

Enovix Corporation (NASDAQ:ENVX ) Q4 2024 Earnings Conference Call February 19, 2025 5:00 PM ET Company Participants Robert Lahey - Head of Investor Relations Raj Talluri - President and Chief Executive Officer Kristina Truong - Chief Accounting Officer Ajay Marathe - Chief Operating Officer Conference Call Participants Jed Dorsheimer - William Blair Ananda Baruah - Loop Capital Markets Colin Rusch - Oppenheimer William Peterson - JPMorgan George Gianarikas - Canaccord Genuity Derek Soderberg - Cantor Fitzgerald Gus Richard - Northland Capital Markets Sean Milligan - Janney Operator Thank you for standing by and welcome to the Enovix Corporation Fourth Quarter 2024 Earnings Conference Call. Currently, all participants are in a listen-only mode.

Enovix Corporation (ENVX) Reports Q4 Loss, Tops Revenue Estimates

Enovix Corporation (ENVX) came out with a quarterly loss of $0.11 per share versus the Zacks Consensus Estimate of a loss of $0.17. This compares to loss of $0.28 per share a year ago.

Enovix: Very Well Positioned In 2025, I'm Long

Enovix, a pre-revenue company, is developing high-performance batteries and aims to start mass production in Malaysia by late 2025. The key to Enovix's success is achieving 95% battery yields, which would enable scaling production and securing major customers. Despite past misjudgments, I'm bullish on Enovix's long-term potential, especially with a Fortune 50 partnership in the works.

Enovix Corporation (ENVX) Expected to Beat Earnings Estimates: What to Know Ahead of Q4 Release

Enovix Corporation (ENVX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Enovix Set To Meet Q4 Expectations, Eyes Smartphone Battery Breakthrough: JP Morgan

JP Morgan analyst Bill Peterson reiterated an Overweight rating on the shares of Enovix Corp ENVX with a price forecast of $15.00.

Enovix Clinches Landmark Purchase Order for Silicon Batteries

ENVX batteries will power the revolution in smart glasses, augmented reality gadgets and other cutting-edge MR products.

SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Enovix Corporation- ENVX

NEW YORK, NY / ACCESSWIRE / January 12, 2025 / Pomerantz LLP is investigating claims on behalf of investors of Enovix Corporation ("Enovix" or the "Company") (NASDAQ:ENVX). Such investors are advised to contact Danielle Peyton at [email protected] or 646-581-9980, ext.

SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Enovix Corporation - ENVX

NEW YORK, NY / ACCESSWIRE / January 10, 2025 / Pomerantz LLP is investigating claims on behalf of investors of Enovix Corporation ("Enovix" or the "Company") (NASDAQ:ENVX). Such investors are advised to contact Danielle Peyton at [email protected] or 646-581-9980, ext.

Enovix Wraps Up Site Acceptance Testing for HVM Line at Fab2

ENVX's completion of SAT is a major accomplishment since it shows that it can effectively commercialize its patented manufacturing process.