Esab Corporation (ESAB)

Esab (ESAB) Is Up 12.19% in One Week: What You Should Know

Does Esab (ESAB) have what it takes to be a top stock pick for momentum investors? Let's find out.

Are Industrial Products Stocks Lagging ESAB Corporation (ESAB) This Year?

Here is how Esab (ESAB) and Generac Holdings (GNRC) have performed compared to their sector so far this year.

ESAB Corporation (ESAB) Q3 2024 Earnings Call Transcript

ESAB Corporation (NYSE:ESAB ) Q3 2024 Earnings Conference Call October 29, 2024 8:00 AM ET Company Participants Mark Barbalato - Vice President of Investor Relations Shyam Kambeyanda - President & Chief Executive Officer Kevin Johnson - Chief Financial Officer Conference Call Participants Mig Dobre - Baird Adam Farley - Stifel Tami Zakaria - JPMorgan David Raso - Evercore Chris Dankert - Loop Capital Bryan Blair - Oppenheimer Operator Thank you for standing by. At this time, I would like to welcome everyone to today's ESAB Corporation Third Quarter 2024 Earnings Call.

Esab (ESAB) Surpasses Q3 Earnings and Revenue Estimates

Esab (ESAB) came out with quarterly earnings of $1.25 per share, beating the Zacks Consensus Estimate of $1.12 per share. This compares to earnings of $1.08 per share a year ago.

Esab (ESAB) Earnings Expected to Grow: Should You Buy?

Esab (ESAB) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

ESAB: Good Execution, Strength In Emerging Markets And Accretive M&A Make Me Bullish

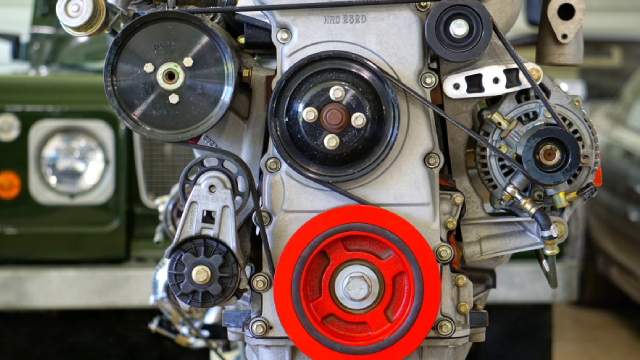

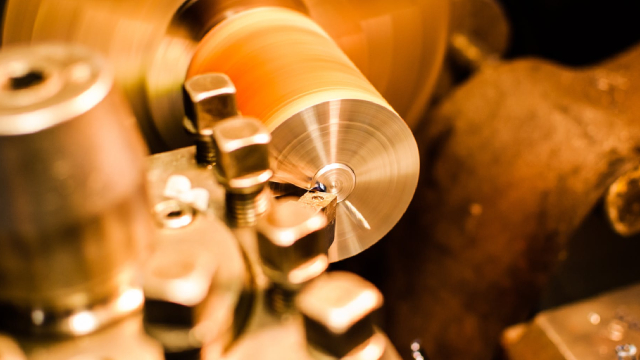

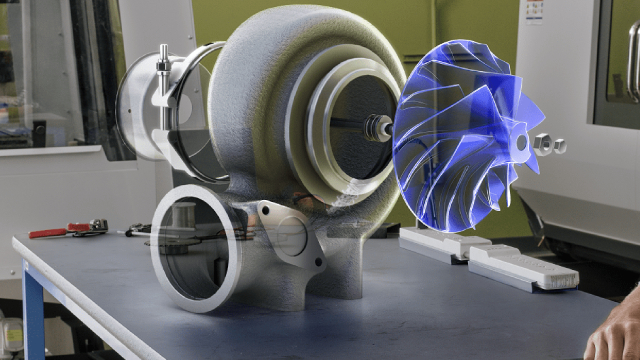

ESAB Corporation faces near-term challenges in key end markets but has strong long-term growth outlook in emerging markets and innovative product launches. Margin growth is expected from product line simplification, footprint rationalization, AI tools, and mix shift towards higher margin equipment sales. Revenue growth supported by organic and inorganic strategies, with focus on emerging markets, reshoring trend, and infrastructure upgrades.

3 Robotics Stocks to Buy and Hold for the Potential of Huge Returns

I am fascinated by robots. From an investment standpoint, robotics looks to be the natural complement to AI's advancement.

ESAB Corporation (ESAB) Q2 2024 Earnings Call Transcript

ESAB Corporation (NYSE:ESAB ) Q2 2024 Earnings Conference Call August 2, 2024 8:00 AM ET Company Participants Mark Barbalato - Vice President, Investor Relations Shyam Kambeyanda - President & Chief Executive Officer Kevin Johnson - Chief Financial Officer Conference Call Participants Mig Dobre - Baird Nathan Jones - Stifel Tami Zakaria - JPMorgan David Raso - Evercore Bryan Blair - Oppenheimer Chris Dankert - Loop Capital Operator Thank you for standing by. My name is Amy, and I will be your conference operator today.

Esab (ESAB) Surpasses Q2 Earnings and Revenue Estimates

Esab (ESAB) came out with quarterly earnings of $1.32 per share, beating the Zacks Consensus Estimate of $1.27 per share. This compares to earnings of $1.21 per share a year ago.

5 Metal Fabrication Stocks to Watch Amid Improving Industry Trends

Easing supply-chain issues and solid end-market demand should aid the Metal Products - Procurement and Fabrication industry's growth. SKFRY, TKR, ESAB, KALU and NWPX are some stocks to watch, backed by their healthy growth prospects.

Is ESAB Corporation (ESAB) Stock Outpacing Its Industrial Products Peers This Year?

Here is how Esab (ESAB) and DNOW (DNOW) have performed compared to their sector so far this year.

Here's Why Esab (ESAB) Could be Great Choice for a Bottom Fisher

After losing some value lately, a hammer chart pattern has been formed for Esab (ESAB), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term.