Eaton Corporation plc (ETN)

Eaton (ETN) Stock Drops Despite Market Gains: Important Facts to Note

In the closing of the recent trading day, Eaton (ETN) stood at $327.03, denoting a -1.04% change from the preceding trading day.

Will Eaton (ETN) Beat Estimates Again in Its Next Earnings Report?

Eaton (ETN) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Why Investors Need to Take Advantage of These 2 Industrial Products Stocks Now

Finding stocks expected to beat quarterly earnings estimates becomes an easier task with our Zacks Earnings ESP.

Eaton Corporation, PLC (ETN) is Attracting Investor Attention: Here is What You Should Know

Eaton (ETN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Eaton (ETN) Stock Dips While Market Gains: Key Facts

Eaton (ETN) reachead $318.71 at the closing of the latest trading day, reflecting a -0.08% change compared to its last close.

The 3 Best Dividend Stocks to Buy Now: July 2024

Finding the best dividend stocks to buy is a popular choice among investors seeking a steady income stream. With market volatility and ongoing uncertainty with interest rates, dividend-paying companies can add an extra layer of stability.

Eaton (ETN) Gains 30.2% YTD: Right Time to Buy the Stock?

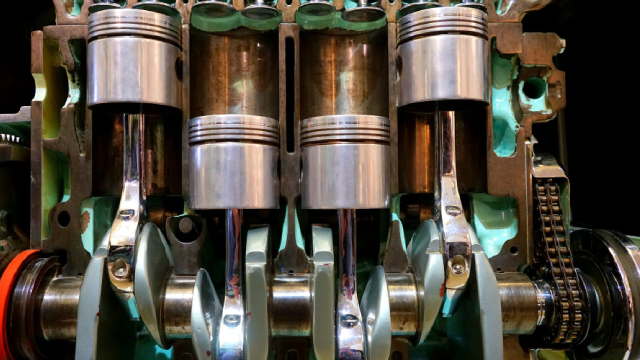

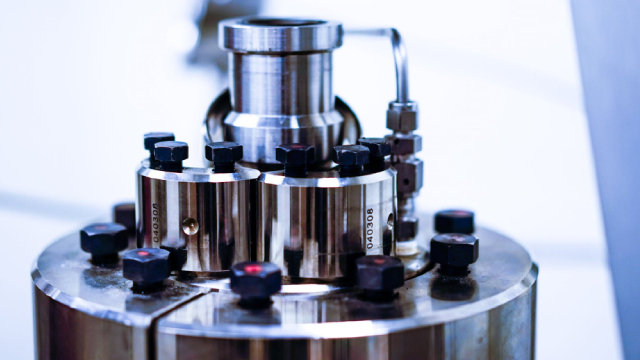

Eaton (ETN), with its wide product offerings in different end markets, will capitalize on rising demand from megatrends, especially in the North American market.

Eaton (ETN) Falls More Steeply Than Broader Market: What Investors Need to Know

The latest trading day saw Eaton (ETN) settling at $323.24, representing a -1.33% change from its previous close.

Eaton Corporation, PLC (ETN) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Eaton (ETN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Little-Known Eaton Stock Is a Hidden AI Gem Worth Discovering

Many investors have never heard of Eaton (NYSE: ETN ), but that's actually great news. Eaton stock can be a hidden gem in your portfolio this year, especially if you're in the market for a “backdoor” or indirect artificial intelligence play.

Why Eaton (ETN) Outpaced the Stock Market Today

Eaton (ETN) closed the most recent trading day at $328.35, moving +0.36% from the previous trading session.

3 Unshakeable Stocks to Buy for Slowing U.S. Growth

The U.S. economy is certainly showing some signs of slowing, raising questions about which stocks to buy for slowing U.S. growth. According to the household survey of the May employment report, the number of people with jobs dropped by 408,000 last month.