FuelCell Energy, Inc. (FCEL)

FCEL vs. BE: Which Hydrogen Power Stock Has Better Potential for Now?

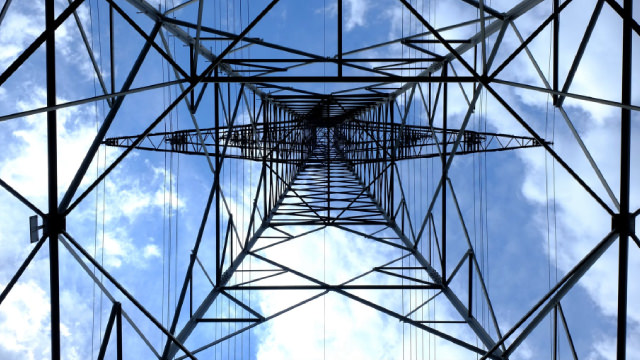

FuelCell and Bloom Energy provide clean electricity through an efficient electrochemical reaction and contribute to reducing emissions.

FCEL Stock Outperforms Industry Past 3 Months: How to Play?

FCEL's sharp three-month surge and rising backlog highlight momentum as fuel-cell demand grows and South Korean projects add support.

These 2 Oils and Energy Stocks Could Beat Earnings: Why They Should Be on Your Radar

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

FuelCell Energy: AI Data Center Enthusiasm Seems Misplaced - Sell

FuelCell Energy reported uninspiring Q3/FY2025 results. While the company has successfully reduced operating expenses, cash outflows remain elevated. The persistent AI data center hype and resulting rally in larger competitor Bloom Energy's shares have attracted a new batch of speculative investors to the company's stock in recent weeks. Since the beginning of the month, FuelCell Energy's common shares have rallied by more than 100%, thus providing the opportunity to raise much-needed additional capital.

What's Happening With FuelCell Stock?

FuelCell Energy (FCEL) , a company that provides design, manufacturing, installation, operation, and servicing of stationary fuel cell power plants saw its stock hit day 6 of a continuous streak of days with gains, with cumulative gains over this period amounting to a 75% return.

FuelCell Energy: A Speculative Pick That Ran Out Of Fuel

FuelCell Energy reported Q3 revenue doubling year-over-year, driven by product sales in Korea, but underlying financial issues persist. FCEL's operating losses surged to $95.4 million, with a net loss of $92.5 million and continued negative margins, highlighting ongoing unprofitability. Short interest has dropped from 22% to 14%, removing the speculative short-squeeze appeal, while share dilution increased to cover cash burn.

FuelCell Energy, Inc. (FCEL) Q3 2025 Earnings Call Transcript

FuelCell Energy, Inc. (NASDAQ:FCEL ) Q3 2025 Earnings Call September 9, 2025 10:00 AM EDT Company Participants Michael Bishop - Executive VP, CFO & Treasurer Jason Few - President, CEO & Director Conference Call Participants Jeffrey Osborne - TD Cowen, Research Division Ryan Pfingst - B. Riley Securities, Inc., Research Division Noel Parks - Tuohy Brothers Investment Research, Inc. Presentation Operator Good morning.

Plug Power vs. FuelCell Energy: Which Fuel Cell Stock has Greater Upside?

PLUG's cost cuts, DOE loan boost and hydrogen expansion may give it the edge over FCEL's rising expenses and debt.

Wall Street Analysts Believe FuelCell Energy (FCEL) Could Rally 39.58%: Here's is How to Trade

The consensus price target hints at a 39.6% upside potential for FuelCell Energy (FCEL). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term.

FuelCell Energy: Poor Prospects Result In Further Restructuring Efforts, Sell

Last week, FuelCell Energy reported another set of uninspiring quarterly results with persistently high cash usage. Unrestricted cash of $177 million dropped to a new multi-year low. New cost reduction initiatives will result in abandoning of the company's solid oxide fuel cell platform, with the move expected to result in substantial impairment charges.

FuelCell Energy, Inc. (FCEL) Q2 2025 Earnings Call Transcript

FuelCell Energy, Inc. (NASDAQ:FCEL ) Q2 2025 Earnings Conference Call June 6, 2025 10:00 AM ET Company Participants Jason B. Few - President, CEO & Director Michael S.

FuelCell Energy (FCEL) Reports Q2 Loss, Tops Revenue Estimates

FuelCell Energy (FCEL) came out with a quarterly loss of $1.79 per share versus the Zacks Consensus Estimate of a loss of $1.51. This compares to loss of $2.10 per share a year ago.