Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan, Copper Demand Short-Term Pain, Long-Term Gain

Investing in basic materials stocks often requires looking around corners into an opaque future. That's been the case for shareholders of Freeport-McMoRan Inc. NYSE: FCX.

Freeport-McMoRan Inc. (FCX) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Freeport-McMoRan (FCX). This makes it worthwhile to examine what the stock has in store.

Gold At Record High: Why Isn't FCX Stock Following Suite?

Freeport-McMoRan (NYSE: FCX), one of the largest producers of copper, has seen its stock underperform over the last month, falling by 8% compared to the S&P 500 which was up 1%. Does this come as a surprise at a time when gold realizations have gone up 35% year-to-year to $2,568 per ounce in Q3 of 2024, and copper realizations are also up 13% to $4.30 per ounce?

Should You Buy Freeport McMoRan While It's Below $50?

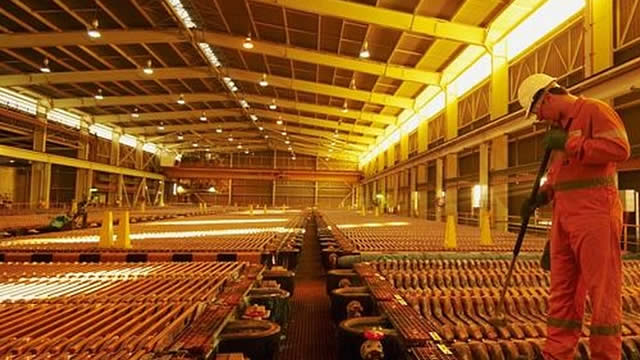

The investment case for the copper miner is based on long-term demand and its ability to expand supply.

Freeport-McMoRan: Good Value Proposition If You Know What You Are Buying

Leaching production provided efficiency gains at the expense of lower copper production. Milling inefficiency in the US was offset by full-capacity operations in South America and excellent low-cost mining in Indonesia. Management guidance lowered EBITDA sensitivity to copper, gold, and energy prices, impacting company valuation. Still, prices around fair value between $44.15 and $48.82 represent a very tradable range.

Freeport-McMoRan Inc. (FCX) is Attracting Investor Attention: Here is What You Should Know

Freeport-McMoRan (FCX) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Freeport-McMoRan Q3 Earnings: The Market Is Not Impressed

Freeport-McMoRan's share price and trading volumes were not influenced by the recent earnings release. Some progress is being made on expansion projects and cost structure, but market participants have shrugged these off. With the production outlook unchanged, copper prices will remain the only game in town for FCX shareholders.

Freeport-McMoRan Inc. (FCX) Q3 2024 Earnings Call Transcript

Freeport-McMoRan Inc. (NYSE:FCX ) Q3 2024 Earnings Conference Call October 22, 2024 10:00 AM ET Company Participants David Joint - Vice President, Investor Relations Richard Adkerson - Chairman Kathleen Quirk - President and CEO Maree Robertson - EVP and CFO Josh Olmsted - President and Chief Operating Officer Conference Call Participants Chris LaFemina - Jefferies Liam Fitzpatrick - Deutsche Bank Bob Brackett - Bernstein Research Michael Dudas - Vertical Research Partners Orest Wowkodaw - Scotiabank Daniel Major - UBS Lawson Winder - Bank of America Securities Bennett Moore - JP Morgan Operator Ladies and gentlemen, thank you for standing by. Welcome to the Freeport-McMoRan Third Quarter Conference Call.

Freeport-McMoRan's Earnings Miss Estimates in Q3, Revenues Beat

Higher copper and gold prices drive FCX's top line in the third quarter despite lower copper sales volumes.

Freeport-McMoRan (FCX) Lags Q3 Earnings Estimates

Freeport-McMoRan (FCX) came out with quarterly earnings of $0.38 per share, missing the Zacks Consensus Estimate of $0.40 per share. This compares to earnings of $0.39 per share a year ago.

What's in Store for Freeport-McMoRan Stock This Earnings Season?

FCX is expected to have gained from higher copper prices and improved sales volumes in the third quarter.

Prediction: Freeport McMoRan Will Soar Over the Next 10 Years. Here's Why.

The outlook for the price of copper is excellent, and this stock is ideally positioned to benefit.