Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan's Lowered FY2025 Guidance Negates Higher Spot Prices

The tariff uncertainties have triggered the higher copper stockpiling and spot prices, which consequently contributed to FCX's robust FQ2'25 numbers on a QoQ/ YoY basis. Even so, the management has unceremoniously lowered their FY2025 sales volume guidance, with the headwinds Grasberg ore grade revision negating the commodities' higher futures contracts. While FCX may tout a $1.7B benefit arising from the US copper premium, it remains to be seen how things may develop as Chile negotiate for tariff exemptions.

Here's Why Freeport-McMoRan (FCX) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here is What to Know Beyond Why Freeport-McMoRan Inc. (FCX) is a Trending Stock

Zacks.com users have recently been watching Freeport-McMoRan (FCX) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Freeport-McMoRan: Re-Rating Ahead On Strong Fundamentals

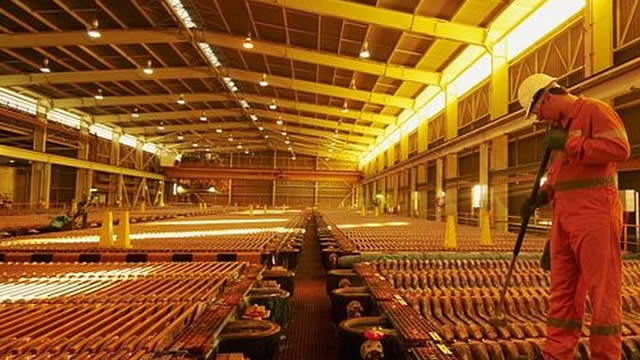

Freeport-McMoRan is a compelling buy, due to strong copper demand, limited new supply, and a leading market position supporting a long-term bull thesis. Financial performance is robust, with rising margins, solid profitability, and shares trading at a discount to peers, despite superior scale and asset quality. My DCF and comparative analysis indicate a fair value of $50 per share, offering 11-12% upside, supported by conservative guidance and potential outperformance.

Freeport-McMoRan: Why I Was Not Impressed With Q2 Results

Freeport-McMoRan delivered a strong Q2 earnings beat, but results fell short of the blowout I expected, given extremely bullish copper and gold fundamentals. Despite favorable catalysts like 50% copper tariffs and a big increase in sequential gold sales, FCX remains stuck in the $30-$50 trading range it's been in for four years. Sales guidance for Q3 is flat on copper and significantly weaker on gold and moly, raising concerns about near-term growth.

Why Freeport-McMoRan Stock May Hit a New High After Earnings Beat

Shares of Freeport-McMoRan Inc. NYSE: FCX are down over 1.3% after the mining company delivered a double beat in its second-quarter earnings report. This is a reversal after FCX had bounced 1.3% higher at the market open.

Freeport-McMoRan Inc. (FCX) Q2 2025 Earnings Call Transcript

Freeport-McMoRan Inc. (NYSE:FCX ) Q2 2025 Earnings Conference Call July 23, 2025 10:00 AM ET Company Participants David Joint - Vice President of Investor Relations Kathleen Lynne Quirk - CEO, President & Director Maree E. Robertson - Executive VP & CFO Mark Jerome Johnson - President & COO of Freeport-McMoRan Indonesia Richard Carl Adkerson - Chief Executive Officer of Freeport- Mcmoran Inc & President of Freeport- Mcmoran Inc Stephen T.

FCX's Q2 Earnings Surpass Estimates on Higher Copper Prices

FCX beats Q2 estimates as higher copper and gold prices drive revenue and earnings growth despite lower production.

Freeport-McMoRan (FCX) Q2 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Freeport-McMoRan (FCX) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Freeport-McMoRan (FCX) Tops Q2 Earnings and Revenue Estimates

Freeport-McMoRan (FCX) came out with quarterly earnings of $0.54 per share, beating the Zacks Consensus Estimate of $0.46 per share. This compares to earnings of $0.46 per share a year ago.

Why Freeport-McMoRan (FCX) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Freeport-McMoRan to Post Q2 Earnings: What's in Store for the Stock?

FCX is likely to post stronger Q2 results on favorable copper prices, lower unit costs, and a rebound in Indonesia sales volumes.