Fortive Corporation (FTV)

Fortive (FTV) Tops Q4 Earnings Estimates

Fortive (FTV) came out with quarterly earnings of $1.17 per share, beating the Zacks Consensus Estimate of $1.12 per share. This compares to earnings of $0.98 per share a year ago.

Fortive forecasts lower-than-expected 2025 profit on sluggish product demand

Industrial products maker Fortive on Friday forecast annual profit and revenue below Wall Street estimates, anticipating sluggish demand for its products.

Fortive Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Fortive Corporation FTV will release its fourth-quarter financial results, before the opening bell, on Friday, Feb. 7, 2025.

Unlocking Q4 Potential of Fortive (FTV): Exploring Wall Street Estimates for Key Metrics

Beyond analysts' top -and-bottom-line estimates for Fortive (FTV), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2024.

Fortive (FTV) Reports Next Week: Wall Street Expects Earnings Growth

Fortive (FTV) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Why Is Fortive (FTV) Up 11.2% Since Last Earnings Report?

Fortive (FTV) reported earnings 30 days ago. What's next for the stock?

Fortive Q3 Earnings Beat Estimates, Revenues Up Y/Y, Outlook Raised

Continued momentum across IOS and AHS segments and robust orders growth aid FTV's third-quarter performance.

After Plunging -7.16% in 4 Weeks, Here's Why the Trend Might Reverse for Fortive (FTV)

The heavy selling pressure might have exhausted for Fortive (FTV) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

Fortive Corporation (FTV) Q3 2024 Earnings Call Transcript

Fortive Corporation (NYSE:FTV ) Q3 2024 Earnings Conference Call October 30, 2024 12:00 PM ET Company Participants Elena Rosman - Vice President of Investor Relations James Lico - President and Chief Executive Officer Charles McLaughlin - Senior Vice President and Chief Financial Officer Conference Call Participants Nigel Coe - Wolfe Research Julian Mitchell - Barclays Joe Giordano - TD Cowen Jeffrey Sprague - Vertical Research Partners Scott Davis - Melius Research Andrew Kaplowitz - Citigroup Andrew Obin - Bank of America Jamie Cook - Truist Deane Dray - RBC Capital Markets Christopher Snyder - Morgan Stanley Joseph O'Dea - Wells Fargo Operator My name is Brock, and I will be your conference facilitator this afternoon. At this time, I would like to welcome everyone to Fortive Corporation's Third Quarter 2024 Earnings Results Conference Call.

Compared to Estimates, Fortive (FTV) Q3 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Fortive (FTV) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Fortive (FTV) Surpasses Q3 Earnings Estimates

Fortive (FTV) came out with quarterly earnings of $0.97 per share, beating the Zacks Consensus Estimate of $0.93 per share. This compares to earnings of $0.85 per share a year ago.

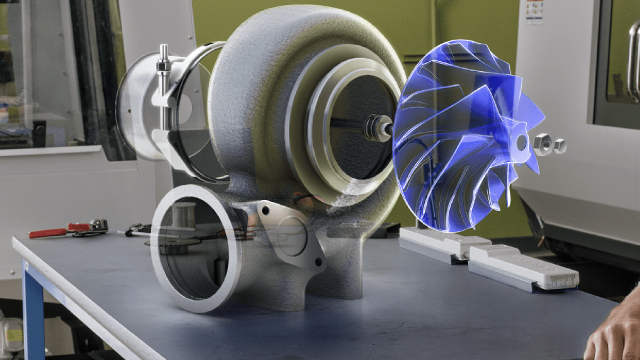

Fortive lifts annual profit view as automation demand drives quarterly beat

Industrial products maker Fortive raised its annual profit forecast on Wednesday, after steady demand for its automation products and services boosted third-quarter profit above estimates.