General Electric Company (GE)

GE Aerospace Set To Trim 91% Gain On Mixed Q3 Results

GE Aerospace posted mixed Q3 results early Tuesday. The manufacturer's lifted guidance wasn't enough to stop a selloff.

GE Aerospace Tops Q3 Estimates, Raises Profit Outlook

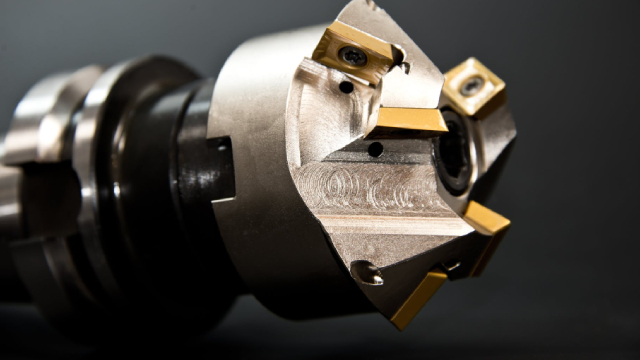

GE Aerospace (GE) reported third-quarter results above expectations Tuesday morning, as Chief Executive Officer (CEO) Larry Culp said the company saw strong demand for its airplane engines and other parts in the quarter.

GE Aerospace raises 2024 profit forecast on strong demand for aftermarket services

GE Aerospace raised its full-year profit forecast for the third time this year on Tuesday, driven by strong demand for aftermarket services from airlines that are relying on older planes to make up for the shortage of newer aircraft.

What To Expect From GE's Q3?

GE Aerospace (NYSE: GE) is scheduled to report its Q3 2024 results on Tuesday, October 22. We expect the company to post mixed results, with revenue of $9.1 billion and earnings of $1.10 per share, compared to the consensus estimates of $9.0 billion and $1.14, respectively.

This GE Vernova Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

GE Vernova Stock Can Rise 30%, Says a New Bull

Deutsche Bank analyst Nicole DeBlase launched coverage of GE Vernova stock with a Buy rating and a $354 price target.

What You Need To Know Ahead of GE Aerospace's Earnings

GE Aerospace (GE) will report earnings for the third quarter Tuesday morning, at a time when the aerospace industry faces some uncertainty with Boeing (BA) workers on strike.

Is a Beat in the Offing for GE Aerospace in Q3 Earnings?

GE's third-quarter results are likely to benefit from strength across its commercial and defense end markets. High costs and expenses are likely to have been spoilsports.

Full Steam Ahead: GE Vernova Inc. Skyrockets Forward

GE Vernova, spun off from GE, has shown impressive growth, rising 77.9% YTD, outperforming peers and the S&P 500 Index. CEO Scott Strazik's leadership and strategic focus on Power and Gas segments are crucial for future growth and profitability. Financial improvements include a significant cash balance increase and better working capital, though challenges remain in the offshore wind sector.

GE Aerospace: Shares Are Too Expensive As Earnings Near

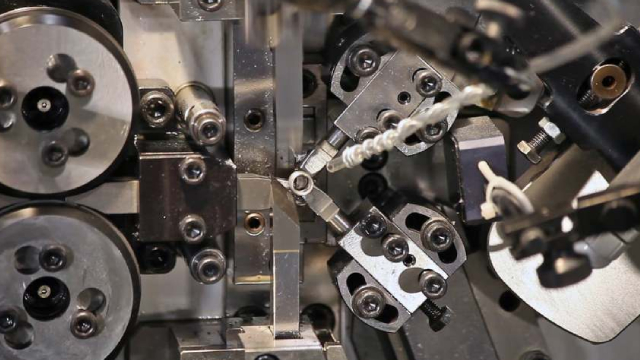

GE Aerospace shares have risen 11.6% since July, outperforming the S&P 500, but concerns about valuation keep my rating at 'hold'. The company showed strong revenue growth, particularly in the Commercial Engines & Services segment, but equipment sales have been weak due to supply chain issues. Despite robust fundamentals and long-term growth potential in the aviation industry, the stock's high valuation prevents me from upgrading my rating.

GE Stock and 4 More Industrial Ideas From a Technical Analyst

Chart Smarter ‘s Douglas Busch believes industrial stocks are poised for more gains soon.

The New Face of GE: Why Aerospace Might Be Worth the Wait

General Electric's fall from grace took years, but now that it is done breaking itself into pieces, the new GE Aerospace is pretty attractive.