General Electric Company (GE)

Is GE Aerospace Going to $200 and Beyond? 1 Wall Street Analyst Thinks So.

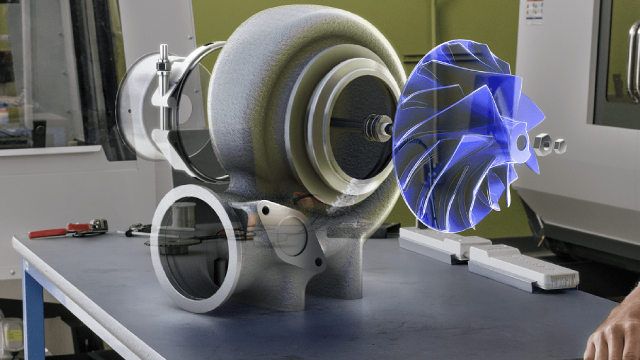

GE Aerospace will generate bundles of cash from long-term aftermarket revenue from its installed base of engines. The company's margins and profits will likely improve significantly over the medium term.

GE Aerospace: Buy, Sell, or Hold?

GE Aerospace is a big player in the wide-moat aviation industry. A strong outlook could drive 30% earnings growth over the next few years.

My New Investment - Why I'm Betting Big On GE Aerospace

I added GE Aerospace to my portfolio due to its ultra-wide moat, market penetration, and strategic position in commercial and defense engines. GE Aerospace's leadership, backed by secular growth trends and the innovative FLIGHT DECK model, makes it a perfect fit for my portfolio. I see strong potential for shareholder value through dividends and buybacks, with continued upside as GE capitalizes on growing demand and operational efficiency.

Here's Why GE Vernova Stock Soared in August

Gas power has a key role to play in the clean energy transition. GE Vernova's wind power business received some good news in August.

GE Aerospace vs. Rolls-Royce: Why analysts favor GE as the leading industrial stock

In a notable shift, GE Aerospace (NYSE: GE) is emerging as the premier industrial stock to own, surpassing Rolls-Royce Holdings PLC (LON: RR) for long-term investment potential.

GE Vernova buys remaining stake in Saudi JV from Dussur

U.S. power equipment maker GE Vernova said on Monday it has acquired the remaining ownership stake in a Saudi gas turbine producing joint venture from state-owned Dussur.

GE Aerospace Hits New High After Spinoff

GE Aerospace soared to a new high after earnings in July. Shares are in a buy zone.

Better Buy: GE Aerospace vs. Lockheed Martin

Defense companies continue to struggle with margins, notably on fixed-price development programs. Commercial aerospace has its own challenges, and has traditionally been a cyclical industry.

GE Vernova falls after turbine blade failure at offshore UK wind farm

GE Vernova's shares fell nearly 7% on Friday following a turbine-blade failure at an offshore wind farm in the UK, the latest in a string of incidents involving the power service firm's equipment.

Is GE Stock Headed Toward $250 Levels?

GE Aerospace (NYSE: GE) has seen its stock rise by around 65% this year, outperforming the broader indices, with the S&P 500 up 18%. The stock now trades at 40x projected 2024 earnings of $4.13 per share.

GE Vernova: Positive Macro Catalysts Are Likely To Boost The Stock

GE Vernova is highly leveraged to global catalysts such as increasing electricity and natural gas usage. The firm's impressive second-quarter results show that it is already benefiting from these trends. GE Vernova's valuation is attractive, making it a buy for medium-to-long-term investors.

3 Wide-Moat Dividend Gems That Are Election Proof

Political bias has no place in investing; history shows market performance is influenced more by economic factors than election outcomes. Instead of reacting to political changes, focus on strong dividend stocks with stable business models and consistent growth for long-term success. Investing in well-established companies ensures portfolio resilience, regardless of who's in office. Stay calm and prioritize reliable dividend payers.