Gamestop Corp. (GME)

GameStop (GME) Exceeds Market Returns: Some Facts to Consider

GameStop (GME) closed the most recent trading day at $27.59, moving +0.47% from the previous trading session.

Is Trending Stock GameStop Corp. (GME) a Buy Now?

Zacks.com users have recently been watching GameStop (GME) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why GameStop (GME) Dipped More Than Broader Market Today

GameStop (GME) concluded the recent trading session at $26.70, signifying a -1.04% move from its prior day's close.

Is Most-Watched Stock GameStop Corp. (GME) Worth Betting on Now?

Zacks.com users have recently been watching GameStop (GME) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

5 High-Flying Large-Cap Stocks to Buy Amid Tariff-Led Market Rout

Despite Extreme volatility, these five stocks have provided more than 4% returns past month. These are: SFM, UNH, SRAD, GME, PODD.

Will GameStop (GME) Gain on Rising Earnings Estimates?

GameStop (GME) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

GameStop CEO purchases additional shares

GameStop Corp (NYSE:GME) shares edged higher before Friday's opening bell on the news that CEO Ryan Cohen has purchased additional shares of the video game retailer. Cohen purchased 500,000 additional shares at $21.55 each for a total of $10.8 million, a regulatory filing showed.

GameStop's stock is climbing again. This is why.

Shares of GameStop Corp. were up 3.7% in extended trading Thursday after Chief Executive Ryan Cohen increased his stake in the videogame retailer and original meme stock.

GameStop Has A Unique Ability To Deploy Its Cash Unlike Any Other Investment Fund

GameStop has transformed from a video game retailer to a cash-rich company, holding $4.8 billion in cash out of $5.9 billion in total assets. CEO Ryan Cohen aims to leverage GME's cash and brand to create a new-age investment holding company, with crypto as a primary target. GME's unique position and loyal investor base provide an opportunity to pursue investment initiatives for mutual profit, including in the crypto and blockchain space.

The 3 Most Talked About Investments on WallStreetBets Right Now

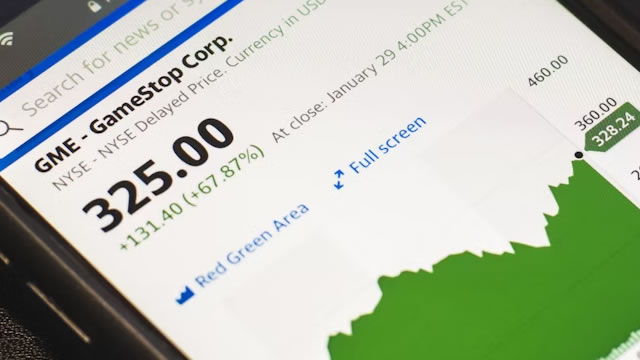

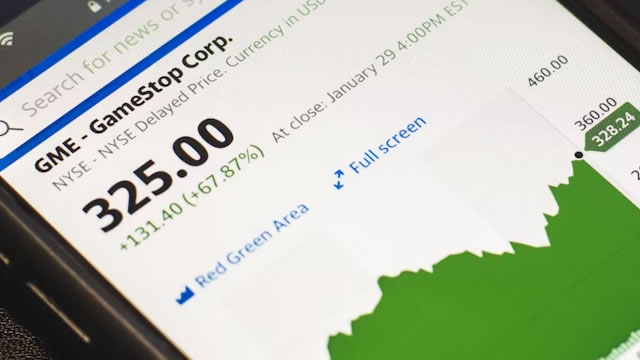

WallStreetBets (WSB) burst onto the investing scene in early 2021 as retail investors banded together to take on institutional players. The popular trading subreddit led a short squeeze against hedge funds with large short positions in GameStop NYSE: GME.

Newsmax IPO draws comparisons to GameStop meme stock mania, as NMAX price surges another 160% today

Shares of Newsmax continued to rise on Tuesday following a massive public debut on Monday, in which shares shot up more than 700% for the best-performing first day since 2022.

GameStop offering pricing prompts analysts to revise price target

Analysts at Wedbush have boosted their price target on GameStop Corp (NYSE:GME) after the video game retailer unveiled the pricing of its offering of $1.3 billion convertible senior notes. The company said the conversion rate to the notes will initially be 33.4970 shares of Class A common stock per $1,000 principal amount of such notes.