Global Technologies Ltd. (GTLL)

Ideal Power gains traction with Forbes Global 500 as it prepares for 2025 initial sales ramp

Ideal Power Inc (NASDAQ:IPWR) expects commercial sales to start ramping up in the second half of 2025 after completing a key milestone ahead of schedule related to its first design win and gaining momentum with large customers. The company is advancing programs in industrial markets and electric vehicles, including collaborations with Stellantis, and expanding its global reach.

JD Logistics: Powering JD Retail And Global Expansion

JD Logistics delivered solid 1Q25 results, benefiting from China's demand-stimulating policies and JD's strong ecommerce performance, especially in electronics and home appliances. Integrated supply chain (ISC) revenue and external customer growth highlight JDL's unique value proposition, with margin pressure offset by scale and service expansion. Valuation remains attractive at 0.26x forward revenue, with 30% upside to HK$15.26/share justified by peer comparisons and JD's ongoing ecommerce momentum.

Oil, Natural Gas, and US Dollar Technical Analysis: Global Risk and Geopolitics Limit Upside

WTI has rebounded from $55 and is consolidating below $65 in preparation for the next move, while natural gas has dropped back to $3.

Global Industrial: Still Undervalued Despite Recent Missteps

GIC is undervalued at $27.4, with intrinsic and relative valuations indicating a fair value range of $33–$43 per share. The Indoff acquisition has hurt margins and distracted management from expanding high-margin Private Label brands, the key value driver. Despite near-term economic headwinds and integration risks, GIC's Private Label growth and cost control can unlock significant upside.

US Global Investors CEO highlights War ETF outperformance amid global tensions - ICYMI

U.S. Global Investors (NASDAQ:GROW) CEO Frank Holmes talked with Proactive about the continued performance of the War ETF, launched in December 2024.

Okeanis Eco Tankers: Surprisingly Resilient In A Volatile Global Landscape

The shipping market in 2025 offers a resilient supply-demand balance, with higher day rates benefiting companies with modern, fuel-efficient fleets. Okeanis Eco Tankers stands out with its efficient fleet, double-digit dividend yield, and strong presence in the tightening crude tanker market. Despite solid returns and operational excellence, Okeanis Eco Tankers' share price lags behind its net asset value, presenting a potential discount for patient investors.

Organigram Global Reports Record Q2 2025 Revenues As Global Footprint Expands

Organigram Global reported record-high revenues for Q2 and improved net income. The company is now selling cannabis beverages in Canada and hemp-derived cannabis beverages in the US. Organigram Global is ramping up its facilities in Canada to meet international demand.

Abacus Global Management riding wave of life settlements growth after Q1 earnings beat

Abacus Global Management (NASDAQ:ABL) is quickly proving its mettle in the alternative asset management space, delivering strong first-quarter earnings that exceeded Wall Street expectations and showcased the firm's growing dominance in life settlements and adjacent financial services. The company posted adjusted earnings per share (EPS) of $0.18 for the first quarter of fiscal 2025, beating consensus estimates of $0.16 and driven by record capital deployment and strong performance in its Life Solutions and Asset Management businesses.

Venture Global Seeks FERC Approval for Third LNG Plant in Louisiana

VG plans to make a final investment decision on the CP2 plant, which is also its third liquefaction plant in Louisiana, subject to FERC???s approval.

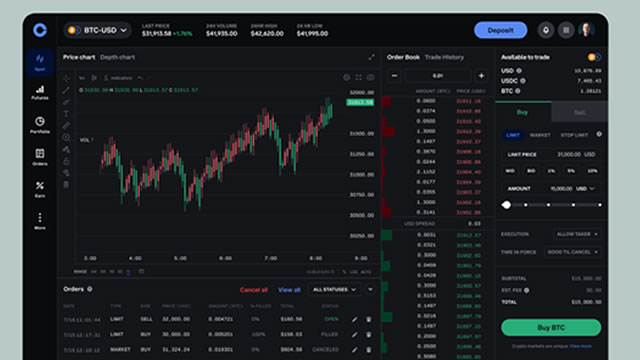

Coinbase Global Says Customer Data Stolen, Held For Ransom

Coinbase Global said an unknown party has stolen customer data and is demanding money in exchange for not publicly disclosing the information.

Baron Global Advantage Fund Q1 2025 Top Contributors And Detractors

Strong performance from Bajaj Finance and MercadoLibre drove quarterly gains, supported by robust growth, solid earnings, and management continuity. Cloudflare remains a high-conviction holding due to durable top-line growth, expanding product offerings, and a unique edge network for AI applications. Nvidia's stock correction was driven by AI adoption concerns, but we maintain high conviction given its differentiated platform and strong datacenter performance.

Venture Global: Bad Stock Performance No Indicator Of Good Operational Outlook

Venture Global's IPO was disastrous, with the stock price dropping from $25 to single digits due to customer arbitration cases and market conditions. VG achieved Commercial Operations at Calcasieu Pass and started producing commissioning cargoes at Plaquemines, rapidly increasing capacity. VG's future earnings will be less sensitive to market pricing, shifting from commissioning cargoes to long-term contracts, reducing volatility of results.