Global Technologies Ltd. (GTLL)

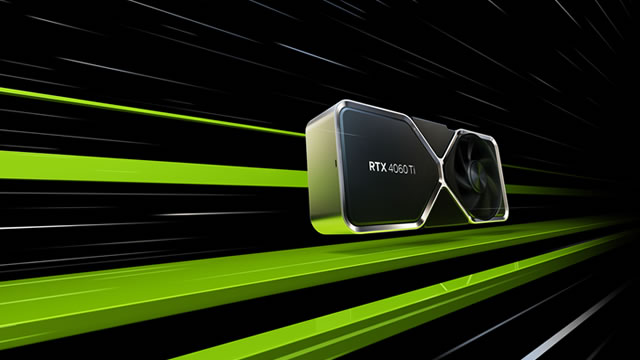

Global tech stocks climb as Nvidia results spark relief rally soothing AI bubble concerns

AI-related stocks in Europe and Asia made gains on Thursday. It comes as investor appetite for AI appeared to be cooling amid bubble concerns.

IBKR Opens Taipei Exchange Access: Another Step in Global Expansion?

Interactive Brokers expands global reach by opening access to the Taipei Exchange, adding new equity, ETF and depositary receipt trading for clients.

M2i Global, Volato Group sign MOU with Nimy Resources for access to Western Australia gallium

M2i Global Inc (OTC:MTWO) and Volato Group have signed a memorandum of understanding (MOU) with Nimy Resources to pursue a supply agreement for gallium sourced from Western Australia, the companies announced on Wednesday. Under the non-binding MOU, Nimy and M2i plan to work toward commercially binding terms for the sale and purchase of gallium from Nimy's Mons Project.

Global Markets Mixed; Dollar Eases, Gold Recovers

U.S. stock futures stabilized after another losing session on Wall Street as investors' focus turned to Nvidia's earnings after the bell.

iShares Global Timber & Forestry ETF: The Worst May Be Yet To Come

I am concluding my research on the forest industry with the iShares Global Timber & Forestry ETF. The companies I have previously covered account for ~25% of WOOD's 225.6 million AUM. The Invesco MSCI Global Timber ETF is WOOD's closest competitor, with a $41.2 million AUM. Smaller size is synonymous with thinner liquidity, as reflected by a higher median bid-ask spread. Despite lower liquidity, CUT's total expense ratio of 1.02% is ~2.5x higher than WOOD's 0.40%. Considering their highly similar portfolios, it is difficult to justify such a spread.

Global stocks sell-off as AI valuation concerns persist ahead of Nvidia earnings

A stock sell-off is underway but experts told CNBC it's a healthy correction. It comes after weeks of chatter about an artificial intelligence-fueled bubble, while Nvidia is also set to report third-quarter earnings this week.

Is Teladoc Health Accelerating Growth Through Global Expansion?

TDOC accelerates global growth as expanding international operations and rising overseas revenues bolster its profitability outlook.

Will Coinbase Business' Debut in Singapore Drive Global Expansion?

Coinbase's Singapore debut for its new Business platform deepens its global push as it scales digital-asset services across Asia.

Should You Look Abroad? Global Equity ETFs to Consider

Stretched U.S. valuations and AI bubble fears have investors looking abroad and are driving interest in international equity and emerging market ETFs.

U.S. Futures Rise, Global Markets Mixed, Nvidia Earnings Eyed

U.S. futures were up after last week's tech selloff on valuation concerns and artificial-intelligence spending.

Global mining giant BHP is found liable in Brazil's worst environmental disaster

A London judge ruled Friday that global mining company BHP Group is liable in Brazil's worst environmental disaster when a dam collapse a decade ago unleashed tons of toxic waste into a major river, killing 19 people and devastating villages downstream.High Court Justice Finola O'Farrell said that Australia-based BHP was responsible, despite not owning the dam at the time, finding its negligence, carelessness or lack of skill led to the collapse.Anglo-Australian BHP owns 50% of Samarco, the Brazilian company that operates the iron ore mine where the tailings dam ruptured on Nov. 5, 2015.Sludge from the burst dam destroyed the once-bustling village of Bento Rodrigues in Minas Gerais state and badly damaged other towns. Enough mine waste to fill 13,000 Olympic-size swimming pools poured into the Doce River in southeastern Brazil, damaging 600 kilometers (370 miles) of the waterway and killing 14 tons of freshwater fish, according to a study by the University of Ulster in the U.K. The river, which the Krenak Indigenous people revere as a deity, has yet to recover.A decade later, legal disputes have prolonged reconstruction and reparations and the river is still contaminated with heavy metals.

5 Top Utility Stocks Powering The Global Grid

Global utilities have outperformed the market in 2025 as soaring electricity requirements boost earnings. Investors should consider utility stocks as part of their core holdings as power demand across the globe continues to surge. High-yielding utility stocks can offer investors potential safety during market volatility and upside exposure to electrification megatrends.