Halliburton Co. (HAL)

Halliburton Stock Down 8% This Year, What's Next?

After an 8% decline since the beginning of the year, at the current price of around $34 per share, we believe Halliburton stock (NYSE: HAL), an energy company organized into the exploration, development, and production of oil and natural gas - has upside potential in the longer run. In comparison, HAL's peer SLB stock (NYSE: SLB) is down 10% this year to $47.

3 Broker-Recommended Stocks That Energy Investors Must Track

Considering the unpredictability and volatility of the energy space, we advise focusing on broker-favored stocks like Halliburton (HAL), Valero Energy (VLO) and Targa Resources (TRGP).

Halliburton (HAL) to Deploy UEM Solution at Norway's Maria Field

Halliburton's (HAL) UEM technology allows Wintershall Dea to use both static and dynamic data in real time for a comprehensive understanding of subsurface conditions and to enrich its reservoir models.

Halliburton (HAL) Stock Dips While Market Gains: Key Facts

The latest trading day saw Halliburton (HAL) settling at $33.48, representing a -1.15% change from its previous close.

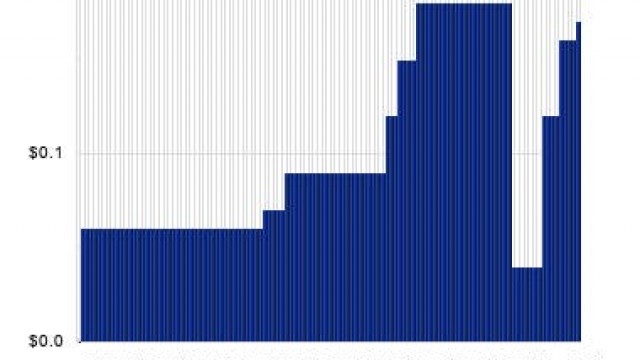

Halliburton Ex-Dividend Reminder - 6/5/24

On 6/5/24, Halliburton will trade ex-dividend, for its quarterly dividend of $0.17, payable on 6/26/24. As a percentage of HAL's recent stock price of $36.70, this dividend works out to approximately 0.46%.

Halliburton (HAL) Falls More Steeply Than Broader Market: What Investors Need to Know

Halliburton (HAL) concluded the recent trading session at $35.81, signifying a -1.94% move from its prior day's close.

Brokers Love These Energy Stocks, It's Time You Take a Look

Considering the unpredictability and volatility of the energy space, we advise focusing on broker-favored stocks like Halliburton (HAL), Valero Energy (VLO) and Targa Resources (TRGP).

Why Halliburton (HAL) Dipped More Than Broader Market Today

In the latest trading session, Halliburton (HAL) closed at $35.98, marking a -1.07% move from the previous day.

Halliburton (HAL), Wintershall Collaborate on UEM Solution

Halliburton (HAL) and Wintershall Dea's UEM solution enhances reservoir modeling with real-time data integration, optimizing reservoir recovery in Maria Field, Norway.

Halliburton (HAL) Invites Africa's Companies to Submit EOIs

Halliburton (HAL) invites local companies to submit EOIs for diverse oil and gas services, promoting African local content and economic growth.