Hudbay Minerals Inc. (HBM)

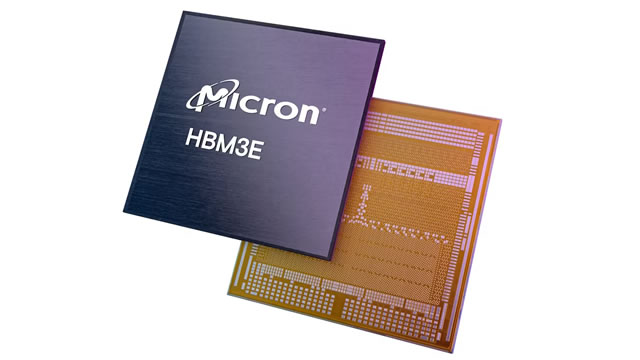

Micron: Capitalizing On The Prolonged Memory Cycle

Micron stock dropped about 40% since June 2024. It seems that Wall Street is assuming that memory cycle has already peaked. Memory Cycle hasn't peaked yet due to ramp up of High Bandwidth Memory (HBM) demand. Micron's revenue will be $3.8B from HBM this fiscal year. Which will offset the decline in NAND and traditional DRAM revenue.

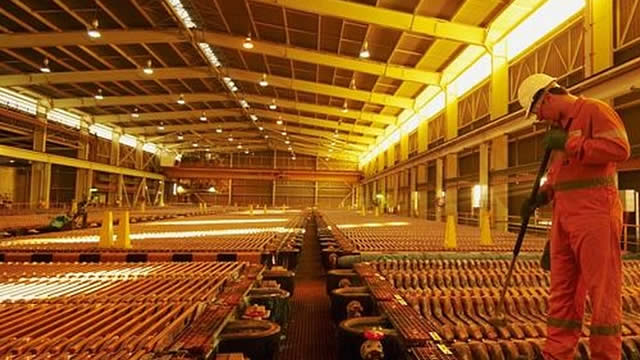

Hudbay Minerals, Inc. (HBM) Q4 2024 Earnings Call Transcript

Hudbay Minerals, Inc. (NYSE:HBM ) Q4 2024 Earnings Conference Call February 19, 2025 11:00 AM ET Company Participants Candace Brûlé - VP, IR Peter Kukielski - President & CEO Eugene Lei - CFO Andre Lauzon - COO Conference Call Participants Orest Wowkodaw - Scotiabank Lawson Winder - Bank of America Securities Dalton Baretto - Canaccord Genuity Anita Soni - CIBC World Markets. Farooq Hamed - Raymond James Pierre Vaillancourt - Haywood Securities Stefan Ioannou - Cormark Securities Operator Good morning, ladies and gentlemen.

HudBay Minerals (HBM) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for HudBay Minerals (HBM) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

HudBay Minerals (HBM) Q4 Earnings Match Estimates

HudBay Minerals (HBM) came out with quarterly earnings of $0.18 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.20 per share a year ago.

Curious about HudBay Minerals (HBM) Q4 Performance? Explore Wall Street Estimates for Key Metrics

Beyond analysts' top -and-bottom-line estimates for HudBay Minerals (HBM), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended December 2024.

Analysts Estimate HudBay Minerals (HBM) to Report a Decline in Earnings: What to Look Out for

HudBay Minerals (HBM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Lam Research: Huge HBM Demand Due To Massive AI Infrastructure Buildout

Lam Research is poised to benefit significantly from the AI infrastructure boom, driven by increasing demand for high-bandwidth memory and advanced logic chips. The company holds dominant market shares in essential semiconductor manufacturing processes: etch (35%), deposition (29%), and cleaning (25%). LRCX's revenue could grow at a CAGR of 15–20% through 2026, supported by booming HBM demand and complex advanced logic manufacturing.

Micron's Low Price Is A Gift

Micron's data center revenue should grow 91% and 38% in FY2025 and FY2026, driven by cloud server DRAM and HBM. The market is not assigning a strong multiple to Micron's largest, most profitable and fastest-growing segment, with HBM3E contributing significantly, and future growth expected from HBM4. Micron should gain from an extremely strong AI market as evidenced by huge CAPEX from hyperscalers, Nvidia's Blackwell growth and Taiwan Semiconductors's forecasts.

Top Growth Picks: 3 Low-Cost Stocks That Could Double in Value

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Samsung: Now In Deep Value Territory

Samsung Electronics faced significant challenges in 2024, including poor execution in the HBM market, increased DRAM competition, and political turmoil in Korea. Despite these issues, Samsung's valuation has reached deep value territory, presenting a buying opportunity for a high-quality business with $66 billion in net cash. Management's rare apology and Jensen Huang's support indicate potential for recovery, especially if Samsung secures HBM supply to Nvidia.

Micron's Growth Is Limited By Sold Out HBM (Rating Downgrade)

Micron's Q1'25 earnings met estimates, but Q2'25 guidance fell short, leading to a -16% after-hours selloff; revenue guidance is $1B below consensus estimates. Capital investments are forecast to grow by 70% for FY25 driven by expanding DRAM & HBM capacity and new facility builds. Despite strong data center performance, the consumer market may not recovery as anticipated as a result of limited consumer discretionary spending.

Micron: Why I Am Aggressively Buying The Drop

Micron Technology reported better than expected fiscal Q1 '25 earnings, but issued weak Q2 '25 guidance, causing a 16% share drop in extended trading. Despite the guidance, Micron's HBM3E memory solutions are driving results, with DRAM revenue growing 87% Y/Y. Micron's valuation draw-down presents an attractive investment opportunity, especially given the expected HBM shipment ramp into FY 2026.