Himax Technologies Inc. (HIMX)

Himax Technologies, Inc. (HIMX) Q3 2025 Earnings Call Transcript

Himax Technologies, Inc. ( HIMX ) Q3 2025 Earnings Call November 6, 2025 8:00 AM EST Company Participants Karen Tiao - Head of IR/PR & Spokesperson Jordan Wu - Co-Founder, President, CEO & Director Conference Call Participants Donnie Teng - Nomura Securities Co. Ltd., Research Division Presentation Operator Hello, ladies and gentlemen.

Himax Technologies, Inc. (HIMX) Q2 2025 Earnings Call Transcript

Himax Technologies, Inc. (NASDAQ:HIMX ) Q2 2025 Earnings Call August 7, 2025 8:00 AM ET Company Participants Jordan Wu - Co-Founder, President, CEO & Director Karen Tiao - Head of IR/PR & Spokesperson Operator Hello, ladies and gentlemen, welcome to Himax Technologies, Incorporation Second Quarter 2025 Earnings Conference Call. [Operator Instructions] As a reminder, this conference call is being recorded.

Himax: Valuation Shows It's Time To Buy

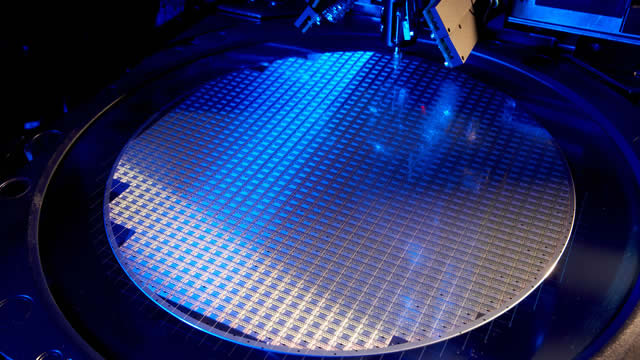

I rate HIMX a Buy due to its strong monetization of automotive cockpit digitization, ultralow power edge AI, and next-gen optical interconnects, coupled with attractive valuation. HIMX's automotive display ICs now contribute over 50% of revenues, growing 20% y/y, highlighting its dominant market share and robust design pipeline. The new alliance with Tata Electronics and PSMC enhances HIMX's display and AI sensing capabilities within India's expanding semiconductor ecosystem.

Himax Technologies, Inc. (HIMX) Q1 2025 Earnings Call Transcript

Himax Technologies, Inc. (NASDAQ:HIMX ) Q1 2025 - Earnings Conference Call May 8, 2025 8:00 AM ET Company Participants Jordan Wu - President and CEO Karen Tiao - Head IR/PR Conference Call Participants Operator Hello, ladies and gentlemen. Welcome to the Himax Technologies, Inc. First Quarter 2025 Earnings Conference Call.

Himax Technologies: A Stock On Sale Despite Many Catalysts

Himax Technologies, trading at $6.32, presents a strong buy opportunity with a P/E of 13, P/B of 1.2, and nearly 5% dividend yield. Positive collaborations with NVIDIA, TSMC, and FOCI, and potential revenue growth from COUPE technology, significantly enhance Himax's long-term market position. Despite recent stock decline, Himax's financial health and improved economic outlook suggest a fair value of $15-$18, with potential upside to $23-$35.

Automotive Drives Solid Revenue Base For Himax Technologies

Himax Technologies excels in automotive display-driver sales, which grew nearly 20% YoY in 2024, now constituting 50% of total revenues. Despite a 4.1% revenue decline, cost-cutting and high-margin automotive products improved gross margins by 260bps; a slight dividend increase is expected. HIMX is well-positioned for long-term growth in EV, AI, AR, and computer vision markets, with strong OEM relationships and innovative product lines.

Himax Technologies, Inc. (HIMX) Q4 2024 Earnings Call Transcript

Himax Technologies, Inc. (NASDAQ:HIMX ) Q4 2024 Results Conference Call February 13, 2025 8:00 AM ET Company Participants Eric Li - Chief IR & PR Officer Jordan Wu - President & Chief Executive Officer Jessica Pan - Chief Financial Officer Conference Call Participants Donnie Teng - Nomura Operator Ladies and gentlemen, welcome to the Himax Technologies Incorporation Fourth Quarter and Full Year 2024 Earnings Conference Call. At this time, all participants are in the listen-only mode.

Himax: Major Market Position Change Ahead

Himax: Major Market Position Change Ahead

Himax Technologies: The Recent Rally May Be Just The Beginning

I maintain my "Buy" rating on Himax Technologies stock due to its imminent turnaround and undervalued forward valuation, despite the recent stock price rally. Recent strategic moves, including a $20 million share buyback and partnerships with Nvidia and TSMC, have significantly boosted investor confidence and stock price. Despite a 7.2% QoQ revenue decrease in Q3 FY2024, Himax exceeded internal guidance and anticipates future growth in the automotive IC and OLED sectors.

Overlooked Stock: HIMX

A.I. continues to dominate, even in small caps. Himax Technologies (HIMX) bolstered a big rally and tapped a new 52-week high.

Himax To Gain Big As TSMC, Nvidia and AMD Advance Silicon Photonics and COUPE Tech: Analyst

TF International Securities analyst Ming-Chi Kuo previously predicted Himax Technologies, Inc HIMX as a potential supplier for Taiwan Semiconductor Manufacturing Co TSM.

Himax Technologies: Current Headwinds Hide A Bright Future

Himax Technologies, a leading Taiwanese semiconductor company, is currently struggling in the midst of an industry downturn, reporting decreasing revenues but also showing cost discipline. The company boasts a low valuation, a healthy balance sheet, and numerous growth opportunities, making it attractive for long-term investors. Recent business developments are promising and support an optimistic long-term perspective for Himax.