International Business Machines Corporation (IBM)

IBM, Jones Lang Unite to Boost ESG Reporting in the CRE Sector

IBM and Jones Lang team up to revolutionize ESG reporting in commercial real estate with a cutting-edge sustainability solution.

IBM Reports Earnings in a Week. One Analyst Says Buy Stock Now.

Evercore ISI analyst Amit Daryanani placed shares of software firm IBM on the firm's Tactical Outperform list.

IBM (IBM) Ascends But Remains Behind Market: Some Facts to Note

In the latest trading session, IBM (IBM) closed at $182.88, marking a +0.03% move from the previous day.

What To Expect From IBM's Q2 Earnings? BofA Forecasts No Change In Annual Outlook

BofA Securities analyst Wamsi Mohan provides earnings preview ahead of International Business Machines Corporation IBM second-quarter results release after market close on July 24.

Up 30% In Last Twelve Months, Will AI And Red Hat Power IBM's Stock Higher Post Q2 Results?

Computing behemoth IBM is slated to report its Q2 2024 results in mid-July, reporting on a quarter that is likely to see the company's sales decline, amid cooling IT spending. We expect revenue to come in at about $14.6 billion, a 6.6% decline compared to the last year, although this would be slightly ahead of the consensus estimates.

IBM (IBM) Outperforms Broader Market: What You Need to Know

IBM (IBM) concluded the recent trading session at $177.64, signifying a +0.92% move from its prior day's close.

Here is What to Know Beyond Why International Business Machines Corporation (IBM) is a Trending Stock

IBM (IBM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

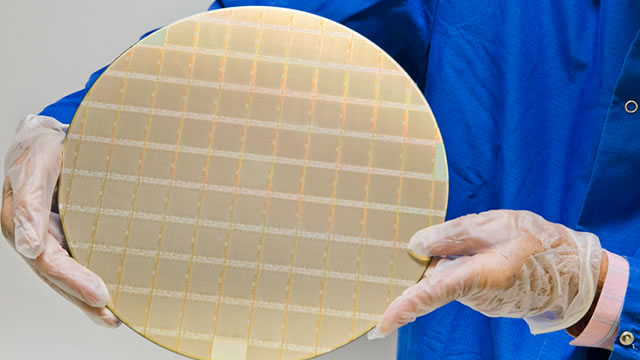

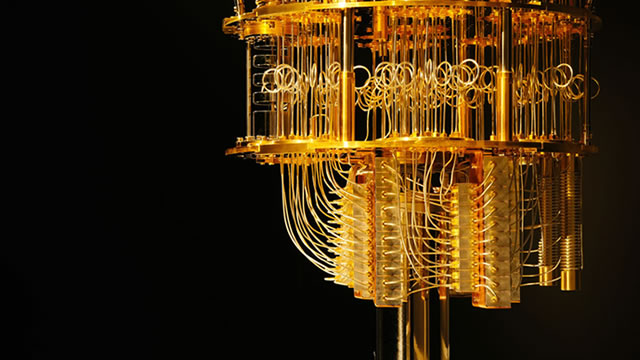

IBM: Quantum Computing, Growth And Dividends

IBM has struggled with growth for over a decade, focusing on share buybacks instead of research and development. The primary business areas for IBM are hybrid and cloud software solutions, consulting, and computing infrastructure. Despite recent growth in the last 3 years, IBM's balance sheet shows high levels of debt and limited room for error.

IBM Enhances AI Scalability With Twin Buyouts: Should You Buy?

With declining earnings estimates, IBM is witnessing a negative investor perception and might not be a prudent investment at the moment.

IBM: Acquisitions, Collaborations, And The Dividend Make Me Bullish

IBM is focusing on cloud services, AI, and consulting for the future, collaborating with Microsoft and expanding its watsonx portfolio. Despite a debt load of $53 billion, the Company's financials are strong, with $20 billion in liquidity and manageable debt obligations. IBM's undervalued stock, strong financial position, and commitment to dividends make it a promising investment in cloud and AI infrastructure.

IBM & Microsoft Collaborate to Boost Cloud Security for Clients

IBM partners with Microsoft to enhance cybersecurity for clients, focusing on modernizing security operations and protecting hybrid cloud identities.

3 Dividend Stocks Yielding Over 3% With Multi-Decade Payout Growth Streaks

High-yield dividend stocks have consistently attracted the attention of Wall Street investors. These stocks not only provide a steady income stream but also offer the potential for capital appreciation.