International Business Machines Corporation (IBM)

Trade Tracker: Stephanie Link buys more IBM

Stephanie Link, CIO at Hightower, joins CNBC's "Halftime Report" to explain why she's buying more IBM here.

IBM Boosts Forecast on AI and Red Hat

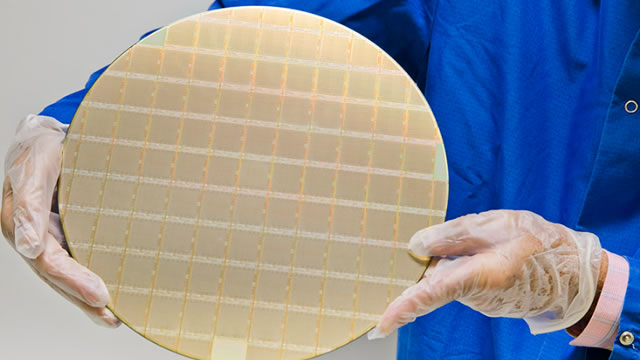

International Business Machines (IBM -7.62%) reported 2Q 2025 earnings on July 23, 2025, delivering $17 billion in revenue and $4.8 billion in first-half free cash flow, driven by standout software and infrastructure gains.

IBM earnings were strong, so why is the stock price sliding today? Here's what has investors spooked

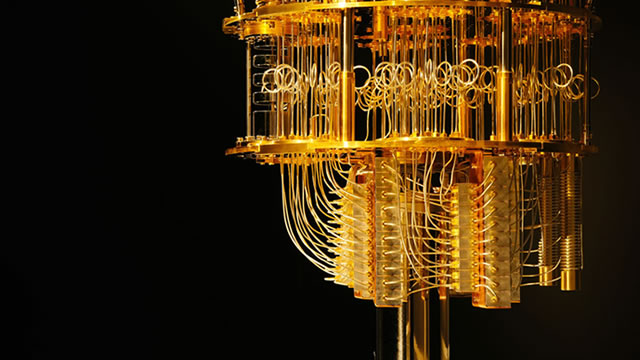

IBM announced strong second quarter 2025 earnings that beat expectations on many points, helped in part by response to its new AI-focused mainframe computer. So why is the stock sliding today?

IBM's stock is sliding. Here's why these analysts see an opportunity to buy.

Analysts are upbeat about the potential for IBM's software business, despite disappointing performance there in the most recent quarter.

International Business Machines Enters Oversold Territory

The DividendRank formula at Dividend Channel ranks a coverage universe of thousands of dividend stocks, according to a proprietary formula designed to identify those stocks that combine two important characteristics — strong fundamentals and a valuation that looks inexpensive. International Business Machines presently has an above average rank, in the top 50% of the coverage universe, which suggests it is among the top most "interesting" ideas that merit further research by investors.

IBM Stock Slides on Disappointing Software Sales

IBM (NYSE:IBM) was last seen down 9.9% at $254.13, eyeing its worst daily drop since October 2021, dragging the Dow Jones Industrial Average (DJI) in response.

IBM Stock Slips on Slowing Software Sales Growth, But Analysts Stay Bullish

IBM (IBM) shares sank in intraday trading Thursday, as slightly weaker-than-expected software revenue growth is weighing on a second-quarter earnings report that largely topped estimates.

IBM Surpasses Q2 Earnings Estimates on Solid Demand Trends

IBM tops Q2 estimates with strong hybrid cloud and AI demand, posting higher revenue, profit and free cash flow.

IBM tops Q2 estimates but software shortfall pressures shares

International Business Machines Corp (NYSE:IBM) reported second quarter earnings that beat expectations on the top and bottom lines, but a miss on software revenue saw its shares fall almost 9% in early trade on Thursday. Total revenue of $17 billion, up 8% year-over-year, was ahead of the Street consensus of $16.58 billion.

IBM Is America's Worst Tech Company

International Business Machines Corp. (NYSE: IBM) stock sold off 5% on mediocre earnings.

IBM stock price just collapsed

International Business Machines (NYSE: IBM) beat all Q2 2025 expectations in regard to profit, reporting $17 billion in revenue, a number far exceeding Wall Street's forecast of $16.6 billion.

IBM Q2 Recap: Outperforming Hyperscalers Still Likely (Upgrade)

IBM delivered strong Q2 results, beating on earnings and revenue, with standout growth in Infrastructure, and solid performance in Consulting and Software. Despite a minor Software revenue miss, IBM's AI-driven growth runway and robust margin expansion reinforce my confidence in its long-term outlook. The recent pullback after a strong YTD rally offers a compelling buying opportunity, with my upwardly revised price target set at $302 per share.