iShares Self-Driving EV and Tech ETF (IDRVCL)

Summary

IDRVCL Chart

IDRV: A Good Bet Beyond Tesla

The iShares Self-Driving EV and Tech ETF offers a cost-effective way to invest in global companies advancing self-driving tech and electric vehicles. IDRV's holdings include Tesla, Li Auto, Arcadium Lithium, XPeng, and BYD, providing a comprehensive view of the EV sector and supply chain. The fund's sector allocation focuses on Consumer Discretionary, Industrials, Materials, and Information Technology, with significant investments in Chinese firms.

IDRV: Starting To Turn The Car Around, Buy Rating

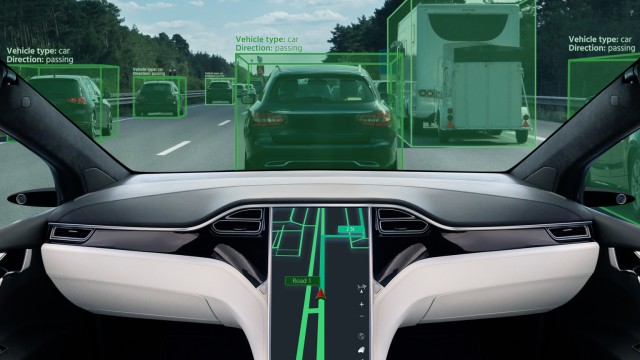

The iShares Self-Driving EV and Tech ETF tracks companies in the EV and tech sectors, focusing on electric vehicles, batteries, and related technologies across 40+ countries. Solid-state batteries and ADAS technology are key industry trends, enhancing EV range, energy density, and safety. Risks include sustainable charging, safety, system failures, and infrastructure readiness; however, the global self-driving EV market is growing at 36% annually.

IDRV: Tariffs And Lack Of U.S. Tech Are Significant Drawbacks

iShares Self-Driving EV and Tech ETF is a hold due to challenges in the autonomous vehicle industry, lack of U.S. large tech companies, and risk of import tariffs. The Fund is globally diversified with even weights on U.S., European, and Asian companies, but lacks well-established U.S. large tech companies. Performance, expenses, and dividends of IDRV compared to peer funds show suboptimal returns despite a lower expense ratio and growing dividend yield.

iShares Self-Driving EV and Tech ETF (IDRVCL) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has iShares Self-Driving EV and Tech ETF ever had a stock split?

iShares Self-Driving EV and Tech ETF Profile

| XSGO Exchange | US Country |

Overview

The described company operates as an investment fund focused on the sectors of autonomous and electric vehicles. It constructs its portfolio by selecting equity securities from companies across 43 developed or emerging market countries, ensuring these companies earn a significant portion of their revenues from industries related to autonomous or electric vehicles. These industries are identified and defined according to specific criteria set by the Investment Definition Index (IDI). By adhering to a strategy that mandates at least 80% of its assets be invested in the securities making up its benchmark index or in other investments mirroring the economic characteristics of these index components, the fund aims to provide investors with exposure to the burgeoning autonomous and electric vehicle industries.

Products and Services

- Equity Securities Investment

- Market Diversification

- Investment Mimicking

This product involves the allocation of funds into stocks of companies actively involved in autonomous or electric vehicle industries across a range of markets. The selection criteria ensure these companies are substantial contributors or benefactors to the growth and advancement of these technological areas, aiming to capture the financial upside of the industry's expansion.

The fund's investment strategy is not limited to a single geographic region; instead, it diversifies its portfolio across 43 developed and emerging markets. This wide market base potentially lowers investment risk through geographical diversification while tapping into the global advancement of autonomous and electric vehicles technologies.

In addition to direct investments in component securities of the index, the company also engages in making investments that have economic characteristics substantially identical to those securities. This could involve derivative instruments or other financial products that mimic the performance of the index components, offering investors a broader range of exposure to the target industries.