Intuit Inc. (INTU)

Here is What to Know Beyond Why Intuit Inc. (INTU) is a Trending Stock

Intuit (INTU) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

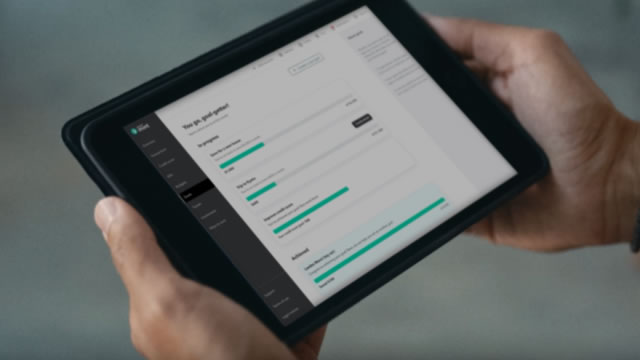

Intuit Expands Money Management Offerings With Deserve Acquisition

Intuit says it is preparing to acquire mobile-first credit card platform Deserve. The deal, announced Monday (April 14), will see Intuit acquire “key technology” and team members from Deserve, part of what Intuit says is its strategy to expand its money management offerings.

Intuit (INTU) Surpasses Market Returns: Some Facts Worth Knowing

Intuit (INTU) reachead $593.69 at the closing of the latest trading day, reflecting a +1.13% change compared to its last close.

Intuit (INTU) Falls More Steeply Than Broader Market: What Investors Need to Know

In the closing of the recent trading day, Intuit (INTU) stood at $556.24, denoting a -0.94% change from the preceding trading day.

Intuit Inc. (INTU) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Intuit (INTU) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Intuit: Steady Performance, But This Tax Leader Already Commands A High Price (Upgrade)

Intuit's diversified revenue streams, including QuickBooks and Credit Karma, have reduced dependency on the volatile tax season, contributing to stable performance amid market volatility. Despite strong fiscal Q2 results and accelerating revenue, Intuit's high valuation and market saturation limit its growth potential and justify a neutral rating. Intuit faces heavy competition in non-tax business software, with rivals like Workday, Oracle NetSuite, and SAP posing significant challenges.

Intuit (INTU) Stock Falls Amid Market Uptick: What Investors Need to Know

Intuit (INTU) closed the most recent trading day at $613.78, moving -0.03% from the previous trading session.

Intuit Inc. (INTU) Is a Trending Stock: Facts to Know Before Betting on It

Intuit (INTU) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Brokers Suggest Investing in Intuit (INTU): Read This Before Placing a Bet

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Buy 3 Wide Moat Stocks to Tap Near-Term Upside and Long-Term Potential

Three Wide Moat stocks have strong short-term and long-term growth potential. These are: NVDA, V, INTU.

Top Wide-Moat Stocks Worth Investing in for Sustainable Growth in 2025

Investing in wide-moat stocks like TSM, NVDA, INTU and SPGI can be a strategy for long-term wealth creation due to their ability to deliver consistent returns.

Intuit Falls 13% in a Year: Is it the Right Time to Buy the Stock?

INTU forms key partnerships and integrates AI into its services, which investors should see as a compelling entry point.