Intuitive Surgical, Inc. (ISRG)

Intuitive Surgical Just Posted a Solid Quarter, but This Is Why the Stock Could Be in Trouble This Year

Intuitive Surgical (ISRG 1.94%) should arguably be doing a whole lot better after coming off the release of some strong earnings numbers. Business is doing well, the growth rate is solid, and in the long run, the company has a lot of potential.

2 Monster Stocks to Buy and Hold Forever

It's hard to predict which way the market, or any specific company, will move in a short period, like a single year. But the longer we expand our horizon, the more likely it is that excellent companies, and equities in general, will deliver solid returns.

Top Wall Street analysts are optimistic about the growth prospects of these 3 stocks

TipRanks' analyst ranking service highlights three stocks favored by Wall Street, including Netflix and Intuitive Surgical.

Is Intuitive Surgical Stock a Buy?

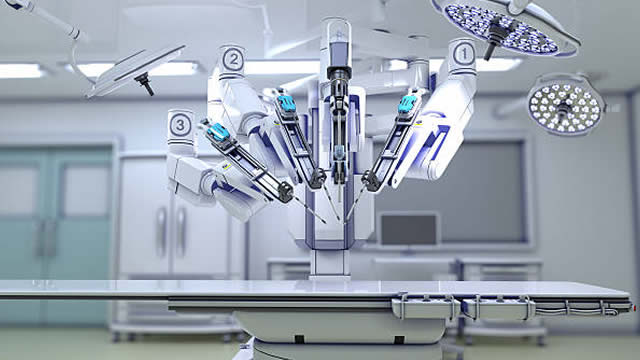

Intuitive Surgical (ISRG 1.30%) capped off a record-breaking 2024 with a blowout fourth-quarter earnings report. For the period ended Dec. 31, the medical technologies (medtech) giant delivered adjusted earnings per share (EPS) of $2.21, well above the $1.79 consensus Wall Street estimate.

Up 950% Over the Past Decade, This Hot Stock Just Saw Its Revenue Soar. Is It Still a Buy?

Over the past decade, Intuitive Surgical (ISRG -0.58%) has proven to be a long-term winner in the healthcare sector. The stock is up more than 950% in that time frame, and more than 60% over the past year.

Is ISRG a Buy After Logging Robust System Placements in Q4?

Intuitive Surgical has maintained an uptrend so far this year on the back of robust da Vinci portfolio performance. The stock has also gained during the past month.

Buy, Sell, Or Hold ISRG Stock At $585?

Intuitive Surgical (NASDAQ: ISRG) recently reported its Q4 results, with revenues and earnings exceeding the street estimates. The company reported revenue of $2.4 billion and adjusted earnings of $2.21 per share, compared to the consensus estimates of $2.2 billion and $1.79, respectively.

Investors Heavily Search Intuitive Surgical, Inc. (ISRG): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Intuitive Surgical (ISRG). This makes it worthwhile to examine what the stock has in store.

Prediction: This Company Will Have a Trillion-Dollar Market Cap by 2040

The list of companies with market caps of $1 trillion or more remains extremely short. However, there's little doubt that more companies will join this elite group over the coming decades.

Intuitive Surgical Drops After Earnings Beat. Wall Street Is Still Optimistic.

The company reported a fourth-quarter earnings and sales beat, but guidance left much to be desired.

Why Intuitive Surgical Stock Was Pulling Back Today

Shares of Intuitive Surgical (ISRG -3.67%) were pulling back today as a strong fourth-quarter earnings report didn't seem to be enough to justify the medical device maker's lofty valuation. Its guidance for 2025 was also slightly below estimates, which can often trigger a sell-off for growth stocks.

These Analysts Boost Their Forecasts On Intuitive Surgical Following Strong Q4 Results

Intuitive Surgical Inc ISRG reported better-than-expected financial results for the fourth quarter after the market close on Thursday.