Intuitive Surgical, Inc. (ISRG)

ISRG Stock Reaches All-Time High: Strength in Uptrend to Continue?

Intuitive Surgical has maintained an uptrend so far this year on the back of robust da Vinci portfolio performance. The has stock also gained during the past month.

Intuitive Surgical, Inc. (ISRG) Beats Stock Market Upswing: What Investors Need to Know

In the latest trading session, Intuitive Surgical, Inc. (ISRG) closed at $549.80, marking a +1.49% move from the previous day.

Intuitive Surgical (ISRG) Upgraded to Buy: Here's What You Should Know

Intuitive Surgical (ISRG) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Reasons to Retain Intuitive Surgical Stock in Your Portfolio Now

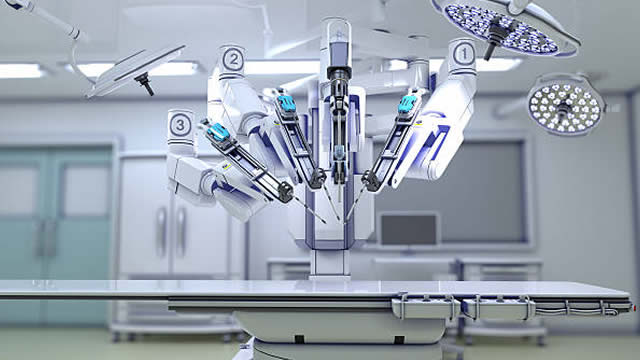

ISRG's strength in robotics continues to raise optimism among investors.

Wall Street Bulls Look Optimistic About Intuitive Surgical (ISRG): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Is Trending Stock Intuitive Surgical, Inc. (ISRG) a Buy Now?

Zacks.com users have recently been watching Intuitive Surgical (ISRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Intuitive Surgical Is Breaking Ground

Intuitive Surgical has become a leader for numerous procedures, and we expect it to continue its growth. The company is seeing double-digit growth both in systems and consumables driving revenue. We expect the company to continue its growth and returns making it a valuable investment.

Is Intuitive Surgical (ISRG) Outperforming Other Medical Stocks This Year?

Here is how Intuitive Surgical, Inc. (ISRG) and Atossa Genetics Inc. (ATOS) have performed compared to their sector so far this year.

Intuitive Surgical, Inc. (ISRG) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Intuitive Surgical (ISRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Will ISRG Stock Continue Its Uptrend After Gaining 9.9% in a Month?

Intuitive Surgical has maintained an uptrend so far this year on the back of robust da Vinci portfolio performance. The stock also gained during the past month.

3 Soaring Stocks to Hold for the Next 20 Years

These stocks may have done well this year, but here's the case for owning them for another two decades or more.

Wall Street Analysts Think Intuitive Surgical (ISRG) Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?