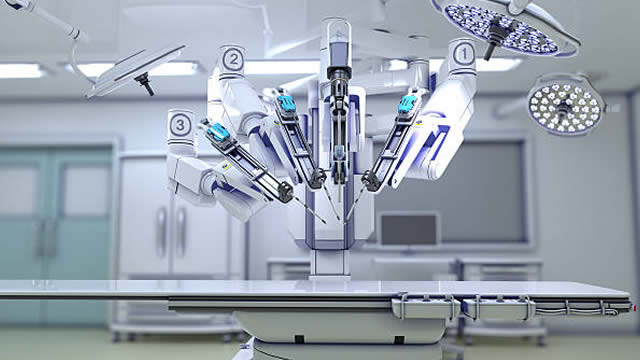

Intuitive Surgical, Inc. (ISRG)

Prediction: 2 Stocks That Will Be Worth More Than Johnson & Johnson 10 Years From Now

Johnson & Johnson hasn't performed that well in the past decade. By contrast, Vertex Pharmaceuticals and Intuitive Surgical have been exceptional.

Is Trending Stock Intuitive Surgical, Inc. (ISRG) a Buy Now?

Recently, Zacks.com users have been paying close attention to Intuitive Surgical (ISRG). This makes it worthwhile to examine what the stock has in store.

3 AI Stocks That You Can Buy and Hold Forever

If you are looking for AI-related stocks you can buy and hold forever, look no further than this list. The stocks on this list are applying AI, and the application of AI counts.

What Are the Hottest AI Stocks Right Now? 3 Top Picks

As I'm sure everyone reading this is aware, artificial intelligence, or AI, has been quite a volatile sector in the recent past. All indicators suggest this will continue in the near to semi-long-term future.

Is Intuitive Surgical Stock a Buy?

Intuitive Surgical has an impressive international growth opportunity with hospitals. Growth and valuation expansion have combined to fuel investment returns.

Should Investors Worry About These 7 Words From Intuitive Surgical's CEO?

Intuitive Surgical's procedure volume in one key category is declining. However, the medical device specialist continues to record excellent financial results.

Brokers Suggest Investing in Intuitive Surgical (ISRG): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Bull of the Day: Intuitive Surgical (ISRG)

Double digit growth is back for the maker of da Vinci.

Intuitive Surgical, Inc. (ISRG) is a Great Momentum Stock: Should You Buy?

Does Intuitive Surgical, Inc. (ISRG) have what it takes to be a top stock pick for momentum investors? Let's find out.

Are Medical Stocks Lagging Intuitive Surgical (ISRG) This Year?

Here is how Intuitive Surgical, Inc. (ISRG) and biote Corp. (BTMD) have performed compared to their sector so far this year.

Intuitive Surgical (ISRG) Hits All-Time High: Will It Go Higher?

Shares of Intuitive Surgical ISRG surged 9.3% last Friday, after the company announced second-quarter results. The share price touched an all-time high of $456.81 and also closed at a record high of $455.01.

Intuitive Surgical Stock Outperforms Market: Highs on the Horizon

Intuitive Surgical's NASDAQ: ISRG stock bucked the broad-market selloff because of its operational quality, performance, outlook, and balance sheet, which has absolutely nothing wrong with it. The B/S highlights for Q2 include a 490 basis point increase in cash and securities and the net cash position.