Itron Inc. (ITRI)

Itron Surges 16% in Past Year: Can the Stock Sustain This Momentum?

ITRI's performance benefits from strong operational execution and robust demand trends across energy and water sectors.

ITRI's CityEdge Helps Helsingborg Accelerate Smart City Transformation

Itron???s CityEdge portfolio is leveraged by the City of Helsingborg in Sweden to become a smart, sustainable and data-driven city.

Wall Street Bulls Look Optimistic About Itron (ITRI): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

ITRI & MSFT to Boost Utility Management With AI-Driven Intelligence

By integrating Itron's IEOS with Microsoft's Gen AI, utilities can use natural language queries to analyze data priorly available only to data scientists.

ITRI Teams With Tesla & Xcel to Deploy Virtual Power Plant in Colorado

Itron teams up with Tesla and Xcel Energy to deploy a virtual power plant in Colorado to enhance the management of DERs, maximizing their value and benefits.

Itron (ITRI) Recently Broke Out Above the 200-Day Moving Average

Itron (ITRI) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, ITRI broke through the 200-day moving average, which suggests a long-term bullish trend.

Itron (ITRI) Crossed Above the 50-Day Moving Average: What That Means for Investors

Itron (ITRI) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, ITRI broke out above the 50-day moving average, suggesting a short-term bullish trend.

Itron & CHINT Global Unveil GCP-Compliant Residential Smart Meter

ITRI and CHINT Global advance global interoperability in smart metering with the first GCP-compliant smart meter.

Itron (ITRI) Advances While Market Declines: Some Information for Investors

Itron (ITRI) reachead $103.91 at the closing of the latest trading day, reflecting a +0.76% change compared to its last close.

Earnings Estimates Rising for Itron (ITRI): Will It Gain?

Itron (ITRI) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

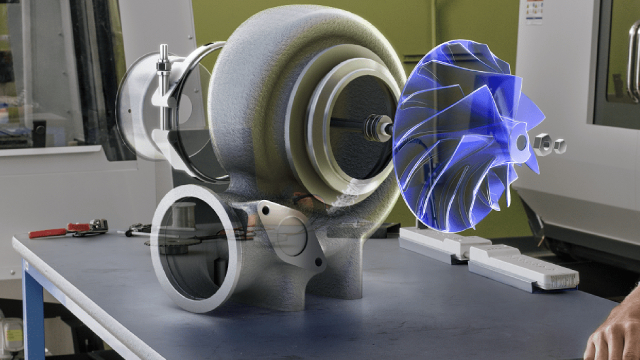

Itron Unveils IntelliFLEX to Boost Grid Flexibility & DER Optimization

ITRI launches IntelliFLEX, a tool that seamlessly integrates DER aggregation, forecasting and AI-driven load balancing across advanced technologies.

Itron (ITRI) Stock Sinks As Market Gains: Here's Why

Itron (ITRI) closed the most recent trading day at $105.82, moving -0.35% from the previous trading session.