JPMorgan Chase & Co. (JPM)

JPM, Others Likely to Hike Dividends After Clearing 2025 Stress Test

JPMorgan, Goldman Sachs, Bank of America and other major banks are poised for dividend hikes as a milder 2025 stress test signals capital strength.

Here is What to Know Beyond Why JPMorgan Chase & Co. (JPM) is a Trending Stock

JPMorgan Chase & Co. (JPM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

JPMorgan Chase & Co. (JPM) Laps the Stock Market: Here's Why

JPMorgan Chase & Co. (JPM) reached $278.27 at the closing of the latest trading day, reflecting a +1.19% change compared to its last close.

What to Expect From the Q2 Earnings Reporting Cycle

The Q2 earnings reporting cycle is underway with the peak of the season still to come. It will begin mid-July with the report from JPMorgan Chase & Company NYSE: JPM, making now a good time to take a look at what to expect.

Jamie Dimon wants workers in the office. So why is he letting JPMorgan's European chief work remotely?

The return-to-office double standard has sparked a conversation online: “Rules for thee but not for me.”

JPM Files Digital Asset Trademark: Set to Ride on Stablecoin Traction?

JPMorgan files for "JPMD" trademark, signaling deeper digital asset ambitions as interest in stablecoins intensifies.

Prediction: This Is Wall Street's Next Trillion-Dollar Stock

Once a rare milestone reserved for the most dominant corporations, trillion-dollar stock valuations have become increasingly common in today's dynamic market.

JPMorgan Chase & Co. (JPM) Registers a Bigger Fall Than the Market: Important Facts to Note

JPMorgan Chase & Co. (JPM) concluded the recent trading session at $264.95, signifying a -1.23% move from its prior day's close.

Is Trending Stock JPMorgan Chase & Co. (JPM) a Buy Now?

Recently, Zacks.com users have been paying close attention to JPMorgan Chase & Co. (JPM). This makes it worthwhile to examine what the stock has in store.

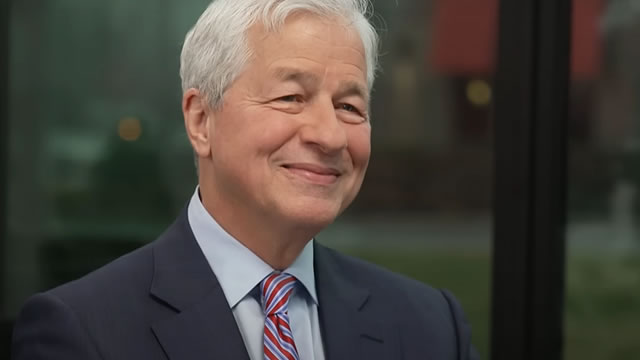

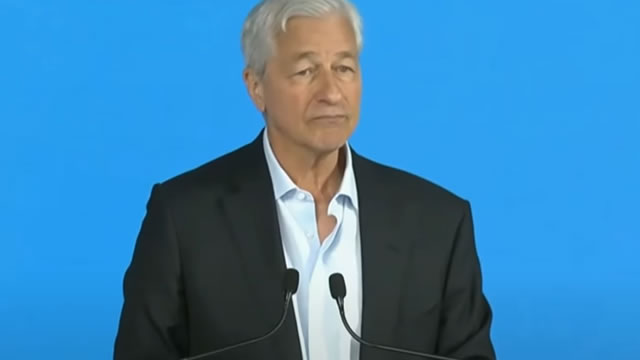

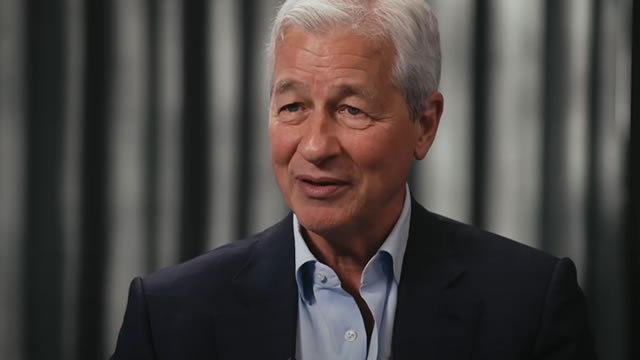

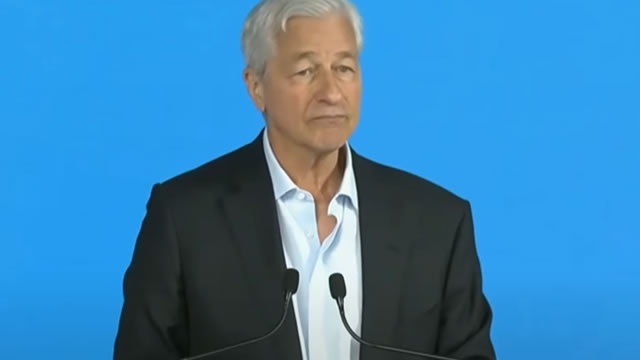

JPMorgan CEO Jamie Dimon warns economic conditions may deteriorate soon

JPMorgan Chase CEO Jamie Dimon warned U.S. economic conditions could deteriorate soon, undermining a potential soft landing with employment declining and inflation rising slightly.

JPMorgan's Jamie Dimon warns U.S. economy could soon 'deteriorate'

Jamie Dimon said the economy's "soft landing" was likely to look weaker going forward. Dimon, who has been CEO of JPMorgan since 2006, has a history of sharing cautious or negative outlooks on the economy.

JPMorgan CEO: ‘Real Chance' US Economic Numbers Will Dip

The head of America's largest bank has a gloomy forecast for the U.S. economy. [contact-form-7] “I think there's a real chance numbers will deteriorate soon,” J.P.