JPMorgan Chase & Co. (JPM)

JPMorgan Credit and Debit Volumes Slow as Reserve for Card Losses Grows

For J.P. Morgan, caution abounds as the bank increased loan loss provisions, designed to cover possible loan losses amid economic turbulence. Management discussed on a conference call Friday (April 11) discussing first-quarter earnings that at the moment, credit performance is in line with expectations, but its outlook also includes an upward revision to expected unemployment.

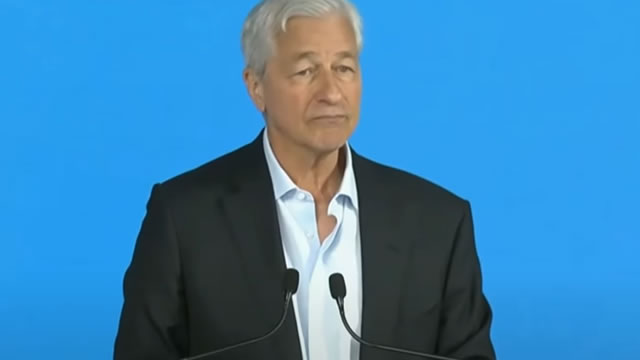

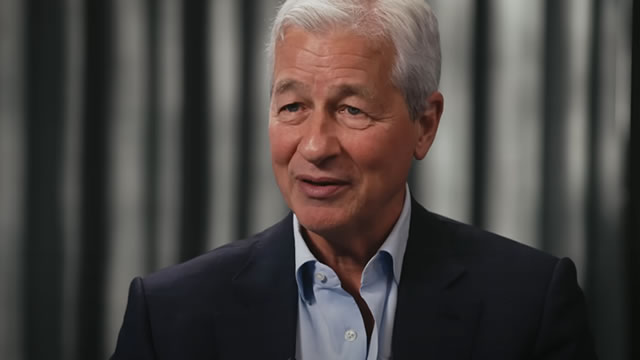

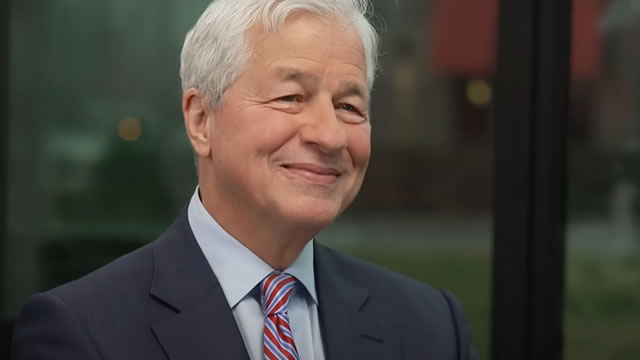

JPMorgan CEO Jamie Dimon Puts the Odds of a Recession at a Coin Flip, But He Says This Economic Cycle Is Different For 1 Reason

Two days after President Donald Trump issued a 90-day pause on higher tariff rates for most countries except China, JPMorgan Chase (JPM 3.14%) CEO Jamie Dimon warned that the "economy is facing considerable turbulence," citing concerns of trade wars, persistent inflation, and fiscal deficits. In JPMorgan's first-quarter earnings call this morning, Dimon placed the odds of a recession at a 50-50 coin flip.

JPMorgan Chase & Co. (JPM) Q1 2025 Earnings Call Transcript

JPMorgan Chase & Co. (NYSE:JPM ) Q1 2025 Earnings Conference Call April 11, 2025 8:30 AM ET Company Participants Jeremy Barnum - Chief Financial Officer Jamie Dimon - Chairman & Chief Executive Officer Conference Call Participants Ken Usdin - Autonomous Erika Najarian - UBS John McDonald - Truist Securities Matt O'Connor - Deutsche Bank Steven Chubak - Wolfe Research Gerard Cassidy - RBC Capital Markets Ebrahim Poonawala - Bank of America Jim Mitchell - Seaport Global Securities Betsy Graseck - Morgan Stanley Mike Mayo - Wells Fargo Securities Glenn Schorr - Evercore Saul Martinez - HSBC Operator Good morning, ladies and gentlemen. Welcome to JPMorgan Chase's First Quarter 2025 Earnings Call.

JPMorgan: Still The King Of Banking

JPMorgan Chase & Co. reported strong Q1 earnings, beating expectations with a 4% revenue and 6% EPS beat, despite macroeconomic uncertainties. The bank's commercial and investment banking unit excelled, with investment banking fees up 12% and overall markets & securities revenue rising 19%. JPMorgan's asset & wealth management unit saw net revenues grow 12% and net earnings rise 23%, benefiting from a 15% increase in assets under management.

Here's why JPM stock is surging

Banking giant JPMorgan held its Q1 2025 earnings call before the market opened on April 11. JPM stock (NYSE: JPM), which closed at $227 a day prior, surged by 3.68% to $235.36 within 20 minutes.

Compared to Estimates, JPMorgan Chase & Co. (JPM) Q1 Earnings: A Look at Key Metrics

Although the revenue and EPS for JPMorgan Chase & Co. (JPM) give a sense of how its business performed in the quarter ended March 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

JPMorgan is a Buy, if You Can Handle The Volatility

JPMorgan's NYSE: JPM stock price correction most likely ended in early April, but that can't be said of the volatility. While the business is solid, healthy, and sufficiently capitalized to weather a raging financial storm, the U.S. economy faces turbulence in the words of CEO Jamie Dimon.

JPM's Q1 Earnings Top on Solid Trading & Higher Loans, Provisions Soar

Robust trading, higher loan balance and decent IB business support JPMorgan's Q1 earnings amid a challenging operating backdrop, which led to higher provisions.

JPMorgan profit rises, but Dimon warns of global risks

JPMorgan Chase & Co (NYSE:JPM, ETR:CMC) reported a 9% rise in first-quarter profit on Friday, as strong trading results and loan growth helped the largest US bank by assets beat Wall Street expectations. But CEO Jamie Dimon warned that the global economy is facing "considerable turbulence," including the prospect of a recession.

JPMorgan's Q1 Review: A Fantastic Quarter

JPMorgan Chase & Co. reported a Q1 2025 EPS of $5.07, beating market expectations by 9.2%, driven by strong top-line growth and effective cost control. The bank's revenue reached $46 billion, surpassing the consensus of $44.14 billion, with significant contributions from the Equity Markets and IB fees. Despite macroeconomic challenges, JPMorgan's robust capital base, increased dividend, and stock buybacks support its valuation, making it an attractive investment.

JPMorgan Chase & Co. (JPM) Beats Q1 Earnings and Revenue Estimates

JPMorgan Chase & Co. (JPM) came out with quarterly earnings of $5.07 per share, beating the Zacks Consensus Estimate of $4.62 per share. This compares to earnings of $4.63 per share a year ago.

JPMorgan's James Dimon warns US faces ‘considerable turbulence' amid trade war threats

Dimon made his comments in a filing as America's biggest bank reported a 9% increase in profits for the start of 2025, registering $14.6 billion in net income for the first quarter of 2025.