JPMorgan Chase & Co. (JPM)

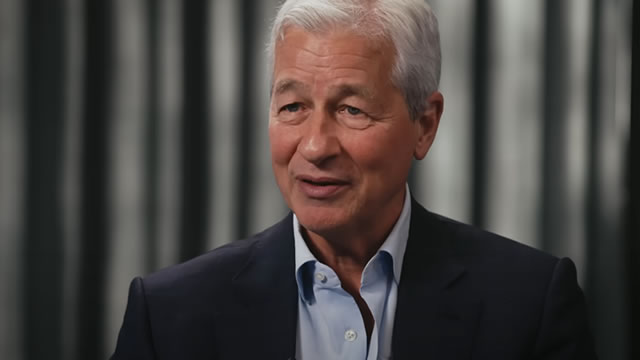

JPMorgan CEO 'very cautious' due to inflationary risk from tariffs and effect on growth

JPMorgan Chase & Co (NYSE:JPM, ETR:CMC) CEO Jamie Dimon struck a cautious tone in his annual letter to shareholders, warning that recent tariffs are likely to push inflation higher and have increased the likelihood of a recession. Recent data has shown the US economy to be resilient, with businesses healthy and consumers freely spending – until some recent weakening.

JPMorgan CEO Jamie Dimon says stock prices remain high even with market selloff

JPMorgan Chase & Co. Chief Executive Jamie Dimon said Monday that tariffs imposed by the U.S. and other countries will increase inflation and boost the probability of a recession.

JPMorgan CEO Jamie Dimon: Trump tariffs will boost inflation, slow an already weakening U.S. economy

CNBC's Leslie Picker joins 'Squawk Box' to break down details of JPMorgan CEO Jamie Dimon's 2025 shareholder letter.

Trump Tariffs Likely to Increase Inflation, Jamie Dimon Says. Why JPMorgan Is 'Very Cautious.

President Donald Trump's latest tariffs likely increase inflation, JPMorgan Chase CEO Jamie Dimon says, warning that ‘unprecedented forces' have made the bank ‘very cautious.'

JPMorgan CEO Dimon warns tariffs could slow US growth, fuel inflation

JPMorgan Chase CEO Jamie Dimon cautioned investors that the turmoil caused by U.S. tariffs and a global trade war could slow growth in the world's largest economy, spur inflation and potentially lead to lasting negative consequences.

JPMorgan CEO Jamie Dimon says Trump tariffs will boost inflation, slow an already weakening U.S. economy

JPMorgan Chase CEO Jamie Dimon said tariffs announced by President Donald Trump will likely boost prices on both domestic and imported goods, weighing down a U.S. economy that had already been slowing. Dimon addressed the tariff policy in his annual shareholder letter.

A Closer Look at Bank Stocks & Tariff Worries

We all know that the banking business isn't subject to tariffs. But as cyclical operators, their business is heavily exposed to trends in the broader economy, which in turn is seen as weighed down by the ongoing tariffs uncertainty.

JPMorgan Set Report Q1 Earnings Next Week: How to Play JPM Stock?

JPM will release Q1 earnings next week. Here, we explore the factors influencing its performance and check whether the stock merits a place in your portfolio.

JPMorgan Chase & Co. (JPM) Expected to Beat Earnings Estimates: Should You Buy?

JPMorgan Chase & Co. (JPM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

JPMorgan hikes global recession odds as Trump imposes sweeping tariffs

JPMorgan Chase & Co (NYSE:JPM, ETR:CMC) has raised its forecast for the probability of a US and global recession in 2025 to 60%, up from 40%, following the announcement of sweeping tariffs by US president Donald Trump. On Wednesday, Trump introduced a 10% base tariff on almost all US imports, along with increased duties targeting dozens of other countries.

10-year Treasury yield tumbles below 4% on fear a trade war will tip economy into a recession

U.S. Treasury yields continued to plummet as investors digested the aftermath of U.S. President Donald Trump's aggressive "reciprocal tariff" policy rollout.

JPM: Sell Ahead Of Earnings

JPM outperformed the U.S. bank index, owing to its high-quality franchise. We think 1Q25 could be a tipping point, with leading economic indicators hinting at macro weakness. The recent rebound highlights investors willing to pile in on high-quality names, but risks linger.