JPMorgan Chase & Co. (JPM)

Why Is JPMorgan Chase & Co. (JPM) Up 8.7% Since Last Earnings Report?

JPMorgan Chase & Co. (JPM) reported earnings 30 days ago. What's next for the stock?

Dave Ramsey Understands That Millionaires Make Their Money Work for Them. Here’s One Way.

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. Personal finance guru Dave Ramsey famously became a millionaire before he turned 30 by investing in real estate, taking on large debts in the process. He then lost it all when his banker called in a loan, and ruined him. But Ramsey pulled himself out of debt, built a new business empire based in media, and today is reportedly worth more than $200 million. I tell you all this for two reasons: First, because everyone loves a good rags-to-riches-to-rags… to riches again story. And second, because I think it’s safe to say that if anyone knows how to become a millionaire, it’s probably a guy like Ramsey, who has done it himself not once, but twice. 24/7 Wall St. Key Points: Dave Ramsey urges his listeners to live below their means to accumulate spare cash. Once saved, cash can be invested in real estate, stocks, bonds, or even just a bank account to grow over time. Opening or adding to a simple bank account is the easiest way to get started making your money work for you. Earn up to 3.8% on your money today (and get a cash bonus). Click here to see how. (Sponsored) Make your money work for you And what does Ramsey have to say about how millionaires make their money, and what they do with it once they’ve got it? In a nutshell, he says that millionaires make their money work for them. But what does this mean, exactly? How do you “make your money work for you”? Well the first step is to get some, money to work with. And for that you must “live below your means,” which simply means spending less money than you earn, so that there’s some money left over to (say it with me now) “work for you.” Once that’s accomplished, the money must be placed somewhere that the magic of compound interest can help it to grow over time. That might be in real estate, which can generate income (from apartment rent, for example), and tends to appreciate in value about 3% to 5% annually over time (but incurs property taxes and maintenance expense). It might be in the stock market, which tends to grow about 10% annually over time (but is subject to occasional stock market crashes, as well as sometimes long periods of flat or modestly negative growth). It might be in the bond market, which has its own quirks and can take some time to understand (different bonds pay different interest rates, for example, and when interest rates go up, the value of any bonds you already own go down). So you see, while there are multiple ways to make money “work for you,” each comes with caveats. The simplest way, of course, to put the power of compound interest to work for you is by opening a bank account. After all, when most of us think of “interest,” we’re probably thinking of the interest that a bank pays you on your checking or savings account. Make your money work harder for you That being said, not all bank accounts are created equal. According to Bankrate.com, the average bank savings account in the U.S. right now pays about 0.6% annual interest. That’s tiny. Even left untouched and allowed to compound for 10 years straight, a bank account paying 0.6% will grow to only $106.17 over 10 years. (And some banks pay even less). The good news is that there’s no reason to settle for “average,” much less below average. A few minutes’ research on the web are all it takes to discover multiple brand-name banks paying 3.8% or more on high-yield savings accounts. And despite what you might fear, these are perfectly ordinary bank accounts, FDIC-insured, with big banking brands behind them. Oh, and an interest rate of 4%, saved over 10 years, will turn $100 into more than $145. Granted, banks usually can only pay above-average rates when they don’t have as many (or any) physical branches to maintain, as do retail banking chains like Chase or Bank of America. But when’s the last time you set foot within an actual bank branch? And even if you do need to visit a branch from time to time, there’s nothing stopping you from maintaining two bank accounts. You might bank with Chase for convenience, for example, and keep a small sum there earning that bank’s 0.01% interest rate, while growing most of your cash faster at a SoFi high yield savings account paying 3.8%. Even if you’re not a millionaire (yet), there’s no reason not to grow your money as fast as possible, as safely as possible, while you wait. The post Dave Ramsey Understands That Millionaires Make Their Money Work for Them. Here’s One Way. appeared first on 24/7 Wall St..

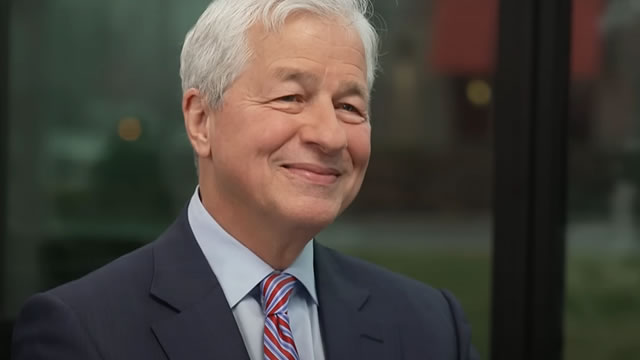

JPMorgan CEO Jamie Dimon blasts call for hybrid work, tells employees not to waste time on petition

CNBC's Becky Quick reports on the latest news.

Exclusive: JPMorgan CEO Dimon derides in-office work pushback, demands efficiency

JPMorgan Chase CEO Jamie Dimon scorned calls from some employees to soften the bank's five-day return-to-office policy in an animated town hall meeting on Wednesday, according to a recording reviewed by Reuters.

JPMorgan reportedly starts first round of layoffs with more cuts later this year

The largest US bank reported a record annual profit as its dealmakers and traders reaped a windfall from rebounding markets in the fourth quarter.

JPM Expects Q1 IB Fees to Rise by Mid-Teens, NII to Trough by Mid-2025

JPMorgan provides an upbeat Q1 outlook for IB and markets revenues. The company also reiterates that NII is expected to trough by the middle of the year.

JPMorgan Chase & Co. (JPM) Bank of America Financial Services Conference (Transcript)

JPMorgan Chase & Co. (NYSE:JPM ) Bank of America Financial Services Conference February 11, 2025 1:00 PM ET Company Participants Jen Piepszak - Chief Operating Officer Conference Call Participants Ebrahim Poonawala - Bank of America Ebrahim Poonawala So next, delighted to welcome Jen Piepszak, who became the Chief Operating Officer of JPMorgan last month. So Jen, thank you so much for joining us.

JPMorgan Chase & Co. (JPM) Presents at UBS Financial Services Brokers Conference (Transcript)

JPMorgan Chase & Co. (NYSE:JPM ) UBS Financial Services Conference February 11, 2025 9:40 AM ET Company Participants Jeremy Barnum - Chief Financial Officer Conference Call Participants Erika Najarian - UBS Erika Najarian Hey guys, so welcome back, welcome back. We have the charismatic CFO of J.P.

JPMorgan sees investment banking fees growth up mid-teens in Q1

JPMorgan Chase Chief Operating Officer Jennifer Piepszak said the lender has seen investment banking fees grow by the mid-teens year over year so far in the first quarter.

JPMorgan Names Veteran Execs to Co-Lead Commercial Banking

JPMorgan Chase has named two longtime executives to oversee its banking business. Matt Sable and Melissa Smith have been named co-heads of commercial banking, the lender said in a news release provided to PYMNTS Friday (Feb. 7).

Musk speaks at JPMorgan event attended by CEO Dimon, source says

Tesla CEO Elon Musk spoke at a JPMorgan Chase conference on Thursday which was attended by the bank's chief Jamie Dimon, according to source familiar with the situation.

The Big 3: JPM, SBUX, VIX

@Theotrade's Don Kaufman turns bearish on JPMorgan Chase (JPM) and Starbucks (SBUX) because he thinks the companies ran up too far, too fast. However, he stays bullish on the CBOE Market Volatility Index (VIX) under the Trump administration.